Copper prices edged lower in Asian trade as the US Federal Reserve began its two-day policy meeting later in the day, with sentiment subdued ahead of this week's interest rate decision.

In China, the world's largest consumer of the metal, copper prices are also being driven down by fears that the slowdown in economic recovery following the pandemic will reduce demand and by rising stockpiles in warehouses.

October copper futures on the Shanghai Futures Exchange extended losses after yesterday's 0.4% drop, falling 0.8% to 68,790 yuan/tonne ($9,426.52).

Three-month copper futures on the London Metal Exchange fell 0.5% to $8,320.50/tonne at 10:00 am today, following yesterday's 0.6% decline.

Analysts noted that investors are awaiting the FOMC meeting at the end of this week, and stressed that the pressure of the yuan's depreciation against the dollar could affect demand for metals.

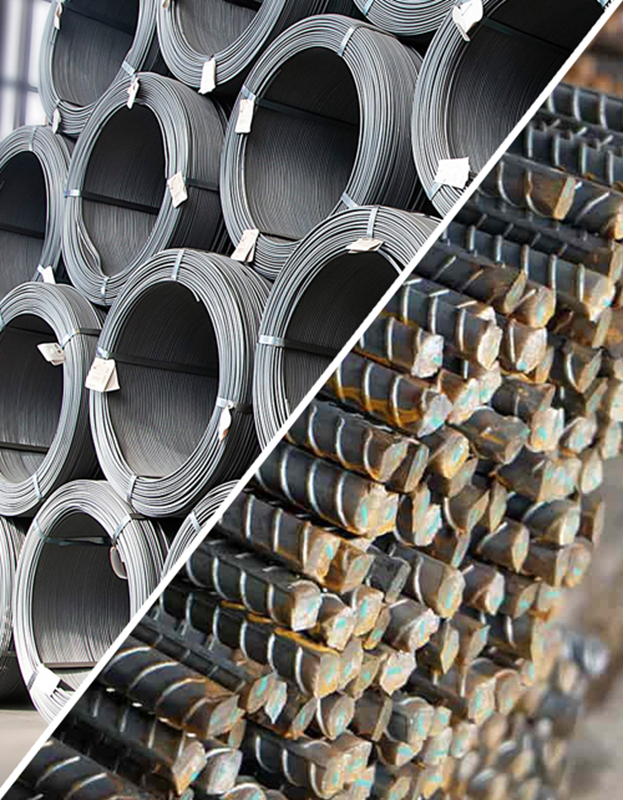

Iron ore futures continued to fall on rising domestic supply and lingering demand concerns in an environment where the property slump undermined investor confidence.

Iron ore futures for January delivery on the Dalian Commodity Exchange (DCE) were trading 0.23 percent lower at 866.5 yuan/tonne ($118.78) at 05.44 BST today, after falling 0.2 percent yesterday.

October iron ore on the Singapore Exchange fell 1.49% to $119.95/tonne.

Analysts said they saw this as a normal downward correction after hitting resistance. Analysts say it is risky to go long in the $120-$130 price range.

In the January-August period, iron ore production rose 7% year-on-year to a total of 659.17 million tonnes, putting pressure on prices, data from the National Bureau of Statistics showed.

Coking coal and coke in Dalian rose 3.26% and 1.24% respectively, supported by tight supply.

Comments

No comment yet.