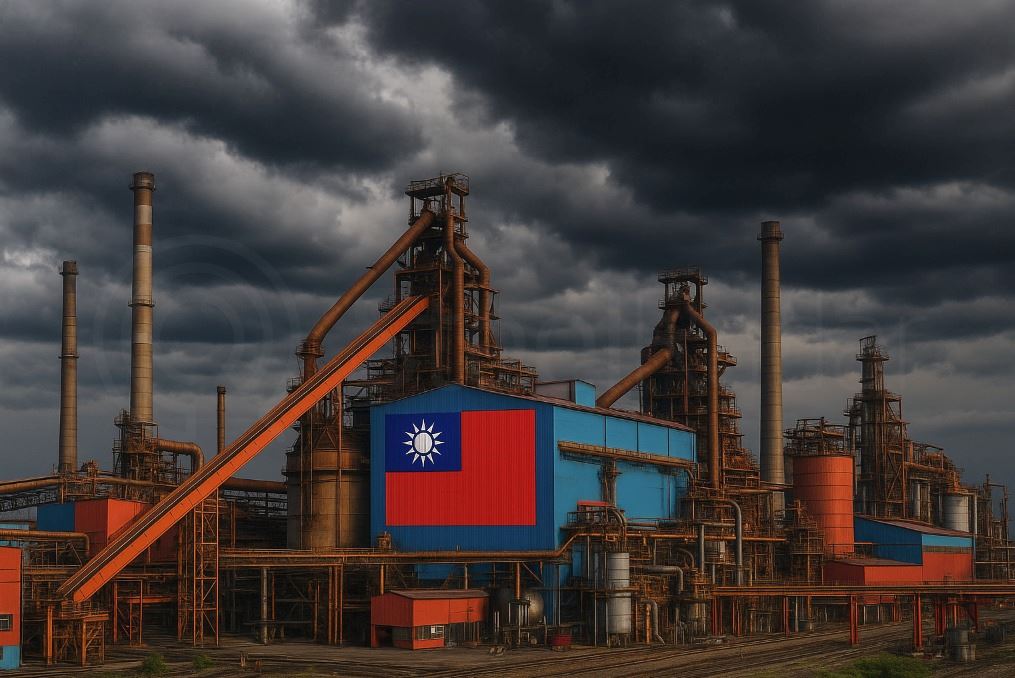

The main driver of pressure in the industry is the slowdown in the construction sector and a general decline in domestic demand. Rebar production has been significantly reduced due to lower incoming orders. This situation negatively affects not only production volumes but also domestic selling prices; while prices remain under pressure, small and medium-sized producers face financial difficulties.

In the external market, low-cost steel from China limits the competitiveness of Taiwanese producers. The decline in average selling prices creates profitability pressure even for major producers. For instance, Taiwan’s largest integrated steel producer, China Steel Corporation (CSC), reported a pre-tax loss of USD 53 million in the first half of 2025. This financial loss is considered one of the weakest performances in the sector over the past five years. Falling sales volumes and price pressure further reduce revenue, increasing losses.

Excess capacity and intense competition in the sector make the situation even more complex. Weak domestic demand prevents production lines from operating at full capacity and pushes smaller producers out of the market. Major players must maintain profit margins and optimize production lines. This has a significant negative impact on consolidated operating profits and pre-tax earnings.

Additionally, structural issues in Taiwan's steel sector increase the pressure. The sector remains focused on traditional production with high costs. Transition to value-added products and green production technologies is slow and limited. This reduces competitiveness and threatens long-term sustainability. Companies such as Yieh United Steel Corp (YUSCO) are addressing these challenges by focusing on high-quality stainless steel production, increasing investment in precision processing, and using low-carbon electric arc furnaces.

While major producers try to stay afloat through strategic and technological moves, small and medium-sized producers struggle to continue operations under financial pressure. The future of the sector appears to depend on innovation, value-added product manufacturing, and modernization focused on sustainability.

Comments

No comment yet.