According to information obtained from the Türkiye Exporters Assembly (TİM), the customs duty rates applied to iron and steel products have been revised in the new customs duty list published by Syria. As part of the update, changes have been made to the customs duty rates applied to the HS (Harmonized System) codes of certain products.

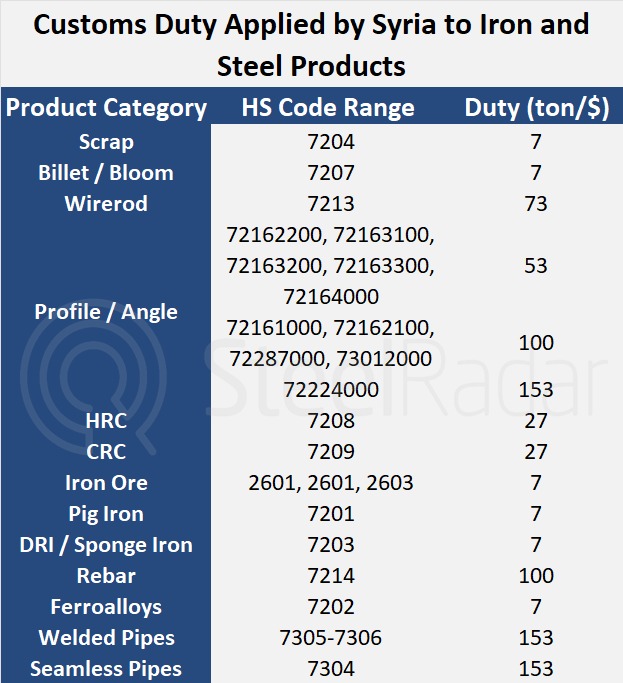

Under the new regulations, customs duties determined according to product groups are as follows:

- Scrap (HS 7204): 7 USD

- Billet/Blum (HS 7207): 7 USD

- Wire rod (HS 7213): 73 USD

- Profile/Angle: 53 to 153 USD depending on the HS code

- Hot-Rolled Flat Products (HRC – GTIP 7208): 27 USD

- Cold-Rolled Flat Products (CRC – GTIP 7209): 27 USD

- Iron Ore (GTIP 2601, 2603): 7 USD

- Pig Iron (GTIP 7201): 7 USD

- DRI / Sponge Iron (GTIP 7203): 7 USD

- Rebar (HS Code 7214): 100 USD

- Ferroalloys (HS Code 7202): 7 USD

- Welded Pipe (HS Code 7305, 7306): 153 USD

- Seamless Pipe (GTIP 7304): 153 USD

TİM announced that exporting companies should pay attention to the updated GTIP list when conducting transactions in the Syrian market. The statement noted that GTIP items subject to tax changes were marked in red and that the original Arabic version of the list was obtained from the Damascus Trade Office.

The updated tax rates are expected to affect costs and competitive conditions in exports to the Syrian market.

Comments

No comment yet.