According to data from the Turkish Steel Producers Association (TÇÜD), the Turkish steel industry showed significant growth last year. In 2024, the country's crude steel production increased by 9.4%, reaching a total of 36.9 million tons. Despite a 7.6% drop in December 2024 compared to the same month of the previous year, production levels remained strong at 2.9 million tons.

Consumption of finished steel products also showed notable increases. December consumption increased by 11.4% to 3.3 million tons compared to December 2023, while annual consumption rose by a modest 0.6% to 38.3 million tons. Capacity utilization increased from 56.8% in 2023 to 62.2% in 2024, reflecting the sector's increasing efficiency.

Export and Import Movements

In terms of trade, Türkiye's exports of steel products have experienced impressive growth. In December 2024, the volume of exports increased by 16% to 1.3 million tons, while the value of exports rose by 11.9% to $888 million. For the year as a whole, exports increased by 27.6% in quantity to 13.4 million tons and by 17.7% in value to $9.7 billion.

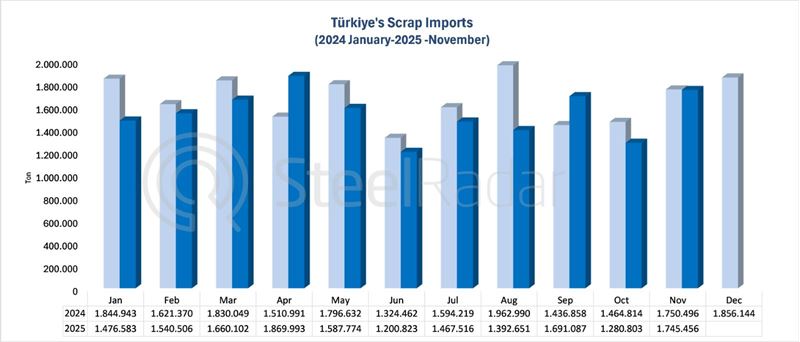

On the import side, imports of steel products increased by 73.8% yoy to 1.8 million tons in December. The value of imports also rose by 37.8% to $1.2 billion. The rise in imports was mainly driven by a significant increase in semi-finished products (100%) and long products (48%). For the full year, imports increased by 1.7% in quantity to 17.4 million tons, but decreased by 9.9% in value to $13.2 billion. The ratio of exports to imports increased from 56.6% in 2023 to 74% in 2024.

Opportunities from Syria's Reconstruction

As Syria enters the long-awaited reconstruction process, Türkiye's steel industry stands to gain significantly from the surge in demand for construction materials. With its large production capacity and strategic geographical location, Turkish steelmakers are poised to play a key role in supplying the materials needed for reconstruction efforts. Industry experts predict that the reconstruction of Syria will lead to a sharp increase in Turkish steel exports, especially in rebar, structural steel and other construction-related products. Given the proximity between the two countries, Turkish producers are well positioned to strengthen their presence in regional markets by offering competitive pricing and fast delivery.

Beyond exports, the restructuring wave is expected to influence Türkiye's domestic steel policies, encouraging improved production strategies to meet both international and domestic demand. This could lead to increased investments in capacity expansion, improved infrastructure for steel production, and policy adjustments to strengthen Türkiye's global competitiveness.

TÇÜD Secretary General Veysel Yayan underlined that Türkiye is the eighth largest crude steel producer in the world and attributed the growth to the country's strong production capacity. Yayan emphasized that Türkiye should implement trade policy measures similar to those in the European Union and the United States in order to sustain the positive momentum in export markets.

Yayan also underlined the importance of developing policies that encourage domestic supply and consumption, utilizing new capacities more effectively and reducing the sector's current account deficit. Yayan expressed optimism about the future of the sector, predicting that capacity utilization rates will continue to rise and steel consumption will increase in 2025 with the transition from tight monetary policies to expansionary policies. Reconstruction efforts in Syria are also expected to have a positive impact on the steel industry next year.

As Syria moves towards rebuilding its cities and infrastructure, Türkiye's steel sector is expected to show steady growth, creating economic opportunities for both countries and consolidating Turkey's position as the leading steel supplier in the region.

Comments

No comment yet.