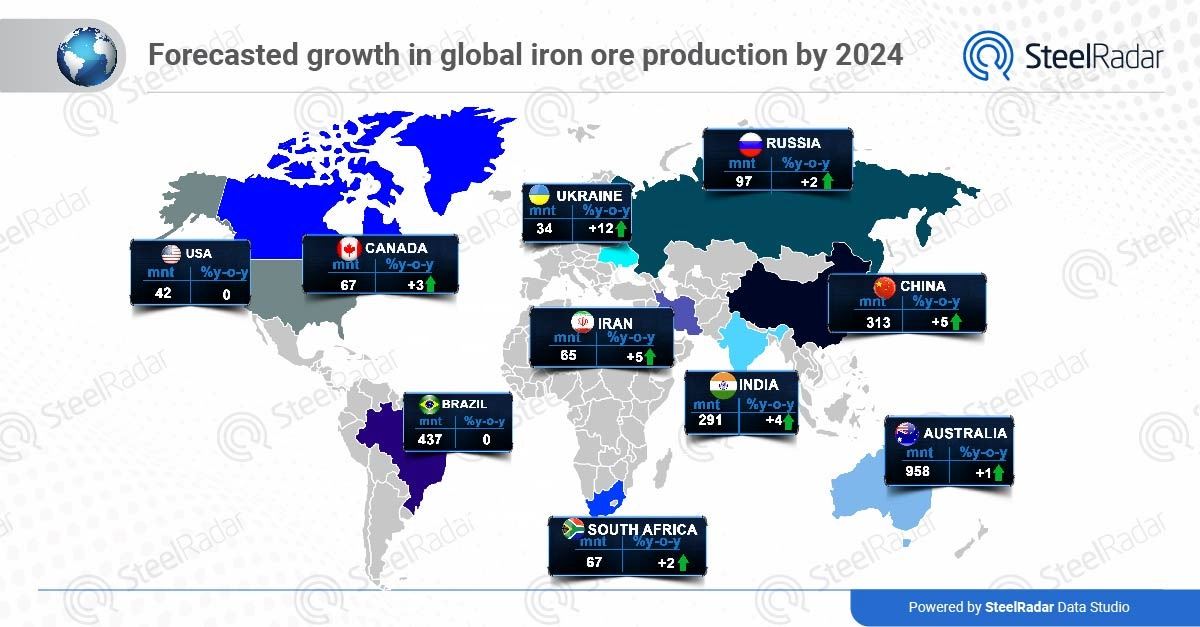

Global iron ore established players like Australia and Brazil maintain their output levels, India’s accelerated growth underscores its emergence as a formidable contender. The surge in iron ore production underscores India's potential to emerge as a dominant force in the global commodities market, signaling a transformative shift in the country's industrial landscape and positioning it in shaping the future of the iron and steel industry worldwide.

Australia: Steady at 437 mnt (0% y-o-y)

Brazil: Resilient at 958 mnt (+1% y-o-y)

China: Surging to 313 mnt (+51% y-o-y)

India: Ascending to 291 mnt (+4% y-o-y)

Russia: Climbing to 97 mnt (+22% y-o-y)

Canada, South Africa, Iran, and others also contribute significantly. Collectively, the world is projected to produce 2,550 mnt of iron ore in 2024, marking a 2% increase overall.

Iran stands tall among the world’s mineral giants, boasting 68 types of minerals within its borders. With 37 billion tonnes of proven reserves and an additional 57 billion tonnes of potential reserves, the country’s mineral wealth is valued at a staggering $770 billion. Among these riches, iron ore takes center stage.

With definite reserves of 3.5 billion tons of iron ore, Iran ranks eighth with its 65 mnt production and trade in the world.

As indicated in the data from the Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO), these companies produced nearly 42.5 million tons of iron ore concentrate in ten months. In the corresponding period of the previous Iranian year, the production was around 39.6 million tons.

Golgohar Mining and Industrial Company: Produced 9.75 million tons

Chadormalu Mining and Industrial Company: Contributed 8.97 million tons

Gohar Zamin Iron Ore Company: Produced around 7.31 million tons

Middle East Mines Industries Development Holding Company (MIDHCO): Accounted for about 4.09 million tons

Sangan Mining Industries Company: Produced roughly 3.28 million tons

Central Iron Ore Company of Iran: Contributed 3.23 million tons

Sanabad Inclusive Development Industrial and Mining Company: approximately 2.19 million tons

Opal Parsian Sangan Industrial and Mining Company: Supplied 2.12 million tons

Sabanour Mining and Industrial Development Company: Produced 1.19 million tons

Jalalabad Iron Ore Complex: Contributed 367,000 tons

Furthermore, these companies collectively supplied approximately 42.5 million tons of iron ore concentrate to relevant firms involved in steel production within the same ten-month period. This represents a 7.5 percent increase compared to the corresponding period last year. Notably, Iran has the capacity to produce an average of 100 million tons of iron ore concentrate annually, which is a crucial raw material for steel production. Furthermore, Iran boasts a steel industry capable of churning out approximately 40 million tons of raw steel and steel products annually.

Iran Central Iron Ore Company played a pivotal role, producing 5,310,000 metric tons of iron ore, with other smaller public sector miners also contributing.

Iran’s mining sector has witnessed substantial investment, accounting for nearly 30% of the country’s total investment in recent years.

Profit margins in mining companies have outshone even Fortune 500 companies, with a remarkable 58% margin.

Iron ore exports play a crucial role, contributing to about 32% of Iran’s non-oil exports.

Iran accounts for 2% of global iron ore production, with major players like Australia, Brazil, India, and China leading the way.

Exports to China have surged, and Iran’s iron ore exports are projected to grow steadily.

Comments

No comment yet.