In the first six months of the current year, Iran’s iron ore concentrate exports have surged by nearly 99%, reaching approximately 6.5 million metric tons. While this figure appears impressive, analysts warn it reflects structural weaknesses in the country’s steel production chain not a pursuit of quick profits.

Keyvan Jafari Tehrani, an international analyst specializing in iron ore and steel, told Nabz-e Bazar in an exclusive interview: “Today’s iron ore exports are primarily a response to the financial pressures faced by small and medium-sized mining operations, not speculative profit-seeking. These enterprises can no longer afford to wait months for overdue payments from domestic steelmakers and are opting instead to export their output mainly to China.”

He added: “China remains Iran’s largest buyer of iron ore, yet our steel-related trade with China is limited. Chinese buyers are reluctant to purchase our intermediate steel products at prices higher than their own domestic offerings. Meanwhile, sanctions and flawed domestic pricing mechanisms have severely hampered Iran’s ability to export finished steel products.”

Jafari Tehrani cautioned that punitive policies such as imposing heavy export tariffs on raw iron ore could have devastating long-term consequences. Citing India’s 2010 experience, he explained: “India imposed a 40% export duty, causing its iron ore exports to plummet from 110 million tons to under 5 million tons within two years. This policy triggered massive capital flight from the mining sector. After four years of economic damage, India was forced to abolish the duty. It then invested heavily in new exploration, ultimately increasing its proven iron ore reserves from 20.5 billion tons to over 33 billion tons.”

Addressing the quality of Iranian iron ore, Jafari noted: “Iranian iron ore generally meets acceptable quality standards, though some deposits contain elevated sulfur or phosphorus levels issues that can be mitigated through processing. The real challenge lies in the lack of integrated, advanced processing infrastructure for hematite deposits, which has led many small hematite mines to shut down.”

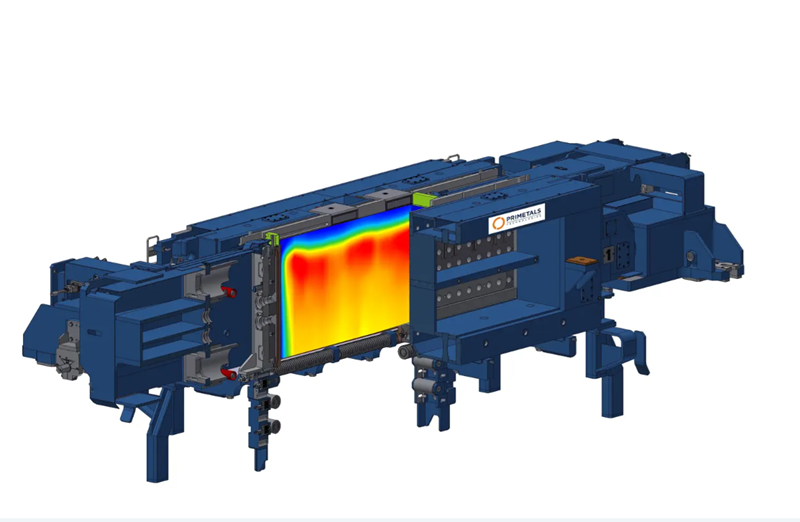

Finally, the analyst warned that Iran’s iron ore reserves could face a critical shortage within the next 14 to 18 years unless proactive measures are taken. “We must channel investment potentially funded by export revenues into new exploration and next generation processing technologies, such as hydrogen-based fluidized bed magnetic roasting for hematite ores,” he urged. “Banning or restricting exports without resolving underlying domestic inefficiencies will only accelerate capital flight and deepen the crisis.”

Comments

No comment yet.