Turkiye's data were evaluated for EU Steel Quotas, the current status of which was researched by SteelRadar. Although export demands seem to be weak in general, very high filling rates were seen in some products.

Optimistic outlook for the section was also prevailing in the past weeks

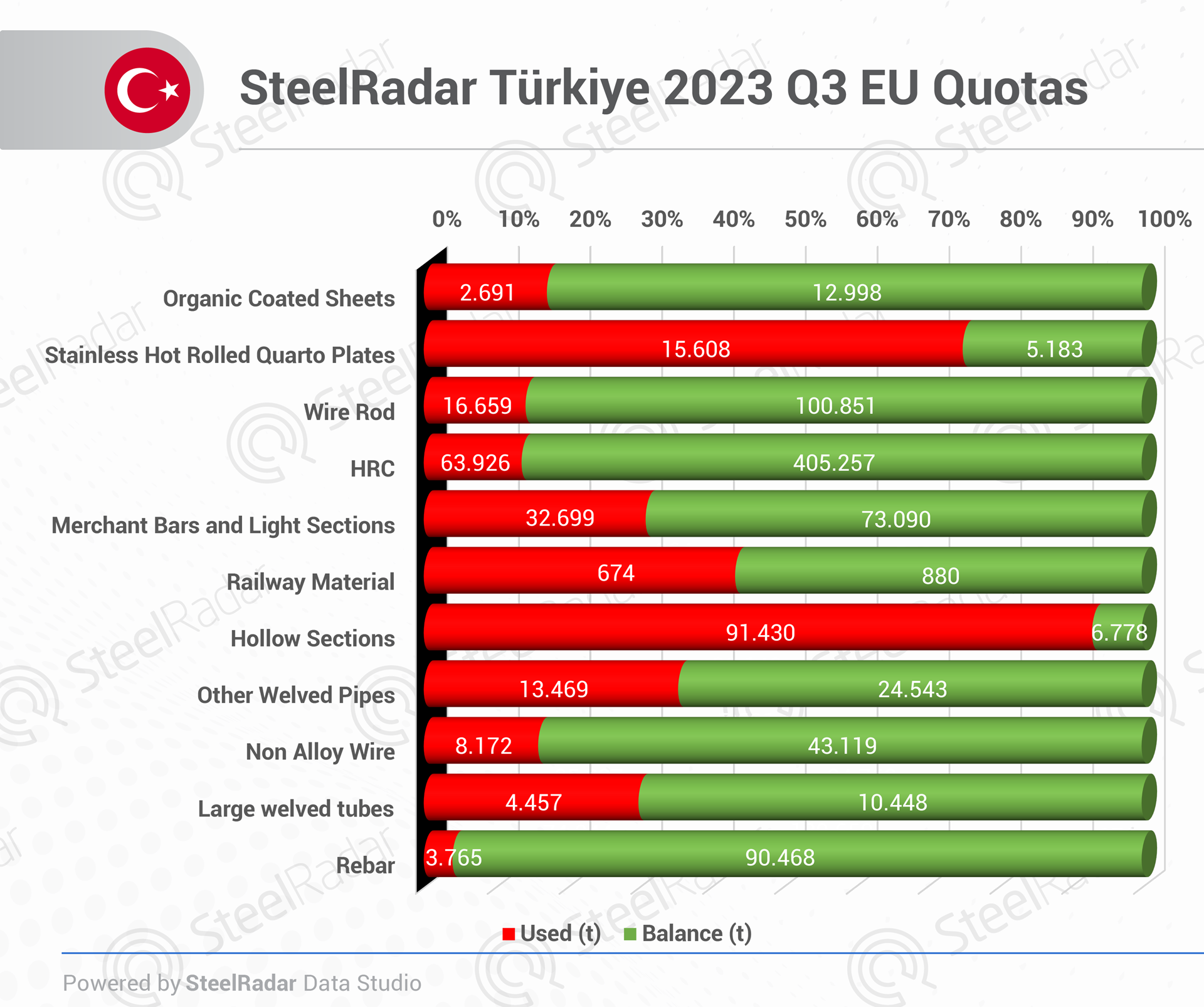

Hollow sections continue to be in high demand by the EU. So much so that Turkıye filled 93.10 per cent of the 98,208/t quota allocated for itself and used 91,430/t.

As for stainless HR Quarto Sheet, 15,608/t of the allocated quota was utilised with a filling rate of 75.07%.

Demand for rebar is almost non-existent

Only 4.00% of the 94,233/t rebar quota allocated to Turkiye by the EU was used. 3,765/t of the rebar quota was used and the remaining amount was recorded as 90,468/t. While demand is expected to accelerate in the last quarter, price instability, the balance in the global market and the earthquake catastrophe caused long producers to go through difficult times. Turkish rebar producers, who have undergone a rapid recovery period, have the power to respond to all demands in the domestic market. It is rumoured that this lack of demand in exports will be short-term and improvements are expected in the coming periods.

There is a global stagnation in flat steel

Although flat steel prices have been in a steep stance for a long time, demand did not support this situation. Of the 469,183/t quota allocated to Turkiye, 63,926/t, or 13.62%, was filled. China is expected to enter the markets at a faster pace to help the demand, which has been concentrated in India and South Korea, recover.

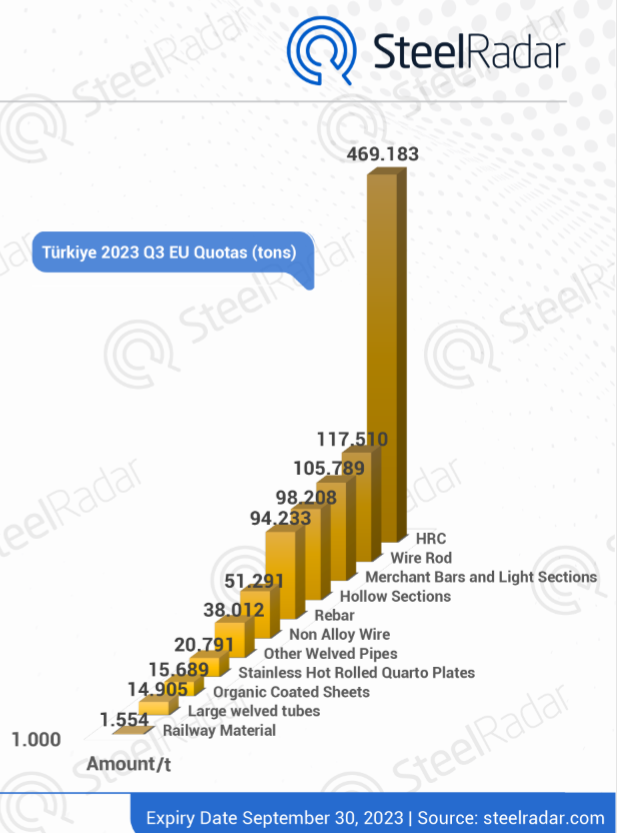

All products and quota amounts were recorded as follows;

Comments

No comment yet.