Export demand in Turkey's rebar stalled, prices could not find equilibrium

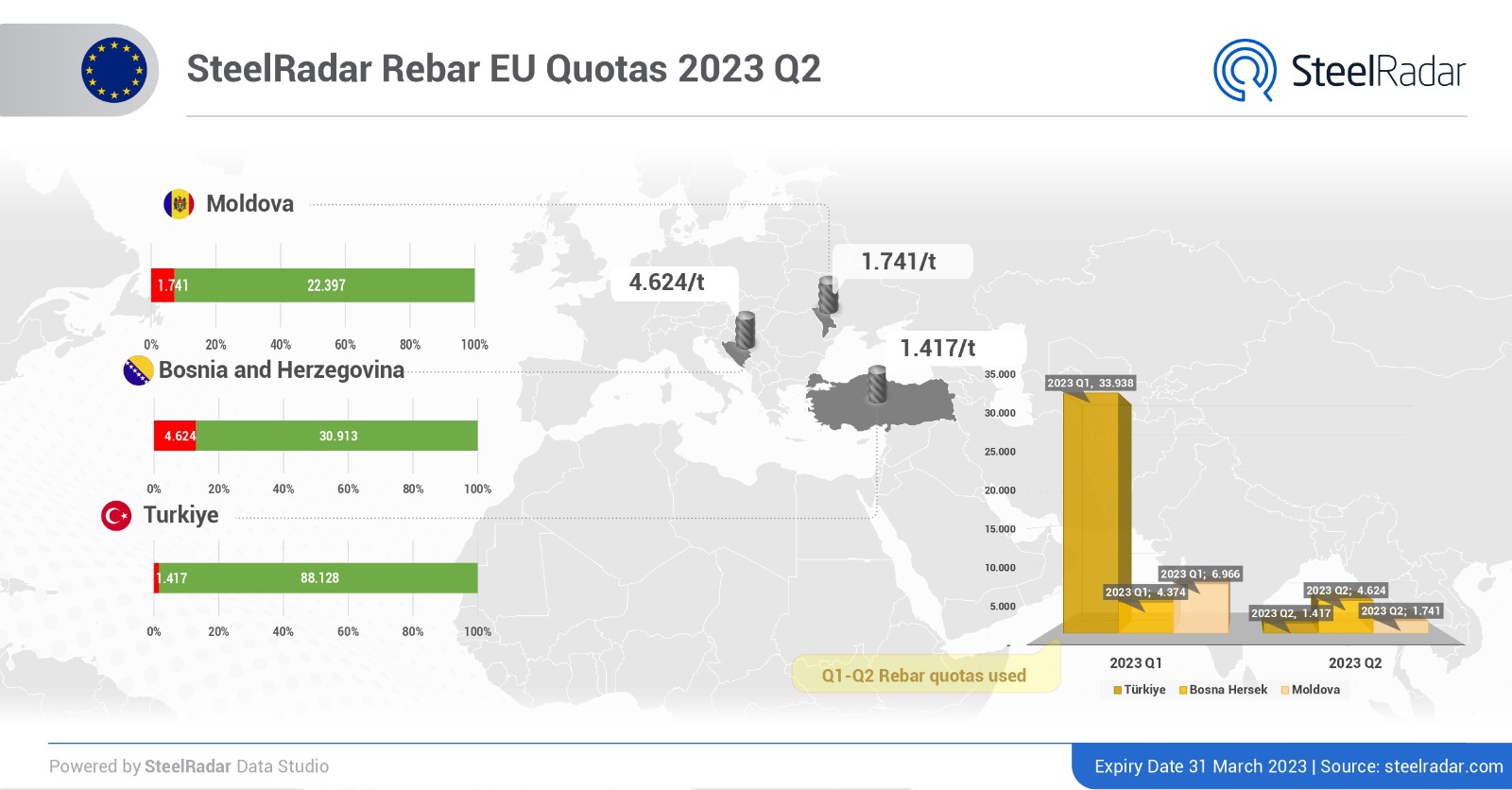

While EU steel quotas left behind the first month of the second quarter of the year in three countries, only 1,741/t quota was used in Turkey. While iron prices are discounted by -20$ to -30$ from the list price at the factories, the weak demand in the domestic market is tiring the rebar prices. Trader-based prices in the spot market are trying to stay strong. On the other hand, Turkey's export demand is quite weak. Quotas, which were rapidly filled in the second month of the last quarter, left the first month behind in the second quarter of the year, and could not even complete the 10% tranche.

The fact that the exchange rate/TL balance was at different points caused a blurred market image in the global market as well as in the local market. In addition, the steel prices in China, which decreased and increased every day in the global market, surprised the expectations of the steel market. Although the optimistic picture expected for China did not materialize in the first quarter, the optimistic market expectation for China in the long run continues. The opinion advocated by the sector stakeholders, who wondered whether Turkey's restoration works will take place before the election, is as follows: "It seems that there will not be a safe market condition in the country without the 14 May election."

In the 2nd quarter of 2023, the quota allocated for Turkey in the EU was 89.869/t, while the current quota amount was recorded as 88.128/t.

EU's Moldovan steel quotas increased slightly compared to the same period in the first quarter

The EU's rebar quota for Moldova increased slightly compared to the same period of the previous quarter. However, there was a decrease in the amount of quota announced in the last quarter, and a total of 27.021/t was recorded in the second quarter of 2023. Only 4,624/t of this has been used so far. In the first quarter of 2023, this figure was seen as 43,811/t with the quotas transferred from the previous year.

Bosnia and Herzegovina remains calm in rebar quotas

The EU's rebar quota for Bosnia and Herzegovina was recorded as 30,913/t. While the first month of the second quarter is behind, 1.417/t rebar quota was used. The remaining quota amount was 30,913/t.

Comments

No comment yet.