The Asian steel market has had a challenging start to 2025 amid rising trade tensions, tariff threats and protectionist measures. As the weak demand outlook for 2024 carries into the new year, SteelRadar is closely monitoring China's stimulus policies and the possible impact of US tariffs.

HRC Market

China's hot rolled coil (HRC) exports may decline in Q1 due to antidumping duties. HRC SS400 FOB China prices closed 2024 down by 17% to USD 471/mt. 2024 Production margins, which briefly increased due to the stimulus policies in September, fell into negative territory at the end of the year. Export prices are expected to fluctuate due to lower domestic demand and antidumping duties.

South and Southeast Asian Markets

In India, stock surplus and sluggish export demand put pressure on the market. The expectation that infrastructure spending will be increased in the federal budget keeps demand hopes alive.

Weak construction activity in Southeast Asia has prompted factories in China and neighbouring countries to look for new export markets. For instance, an Indonesia-based producer concluded log deals for February shipments to Egypt and South America at $435-437/mt FOB for February delivery. However, buyers in Manila placed orders for March 5SP cargoes at only $445/mt CFR. This price is $15-20/mt lower on an FOB basis compared to other regions.

Moreover, Asian billets appear to have lost their attractiveness to Turkish buyers. Turkish buyers believe that the pricing of Asian imports is not competitive enough to minimise market volatility. According to the data, the price differential between CFR Southeast Asia billet and CFR Türkiye scrap increased from $85-90/mt in September 2024 to around $120/mt in January 2025.

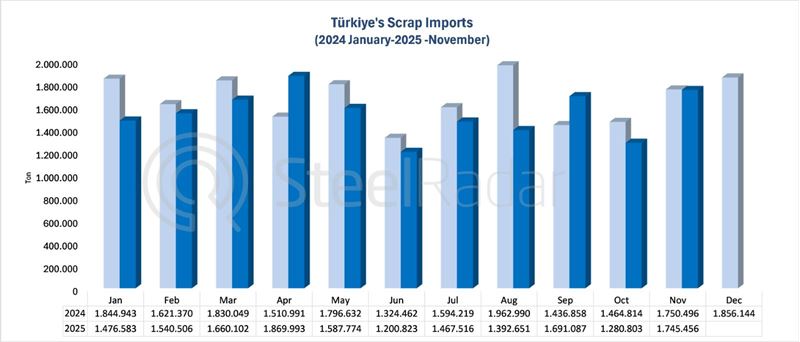

Scrap Market

Asian scrap prices fell sharply in Q4 2024 due to high inventory levels and competitive billet prices. Containerised HMS 80:20 CFR Taiwan index fell from USD 331/mt in October to USD 284/mt in December. In January, restocking activities and higher scrap prices in Türkiye led to a partial recovery. However, the market is cautious due to uncertainty.

The Asian steel market is going through a difficult period in the first quarter of 2025 due to trade uncertainties and falling demand. China's stimulus policies and possible US tariffs will be decisive for the short-term direction of the market.

Comments

No comment yet.