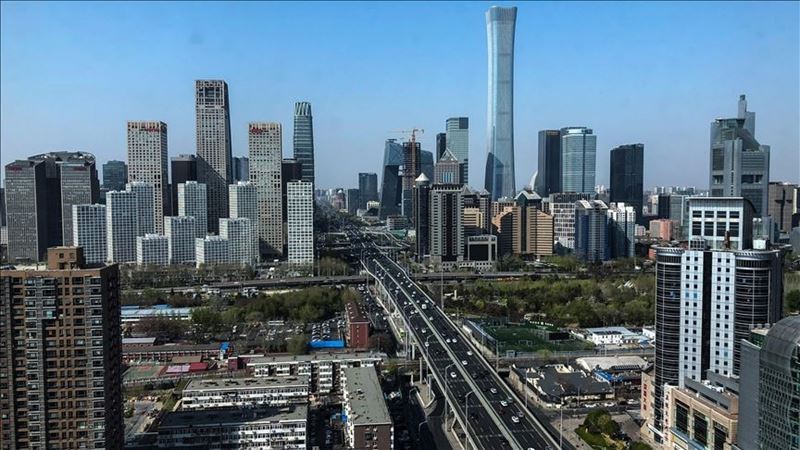

As a new indication of the economic slowdown in China, a decline in foreign direct investment (FDI) has been observed.

Foreign direct investments in China experienced a year-on-year increase of 0.5% in US dollar terms during the first quarter of 2023 compared to the same period last year. However, there has been a downward trend in FDI during the months of April and May.

According to the Ministry of Commerce of China, foreign direct investments in the country declined by 5.6% year-on-year to $84.35 billion during the January-May period.

While foreign direct investments had shown a 0.5% annual increase in the first quarter of 2023 compared to the same period last year, they decreased by 3.3% in the first four months.

During the same period, China's outbound direct investments (ODI) increased by 16.1% year-on-year to reach $51.78 billion.

Signs of economic slowdown

The ongoing downward trend in foreign direct investments indicates the impact of both external conditions and the economic slowdown in China.

May data reveals that the economy has struggled to maintain the growth momentum achieved in the first quarter of this year following the stagnation in the final quarter of last year.

According to data from the National Bureau of Statistics of China, industrial production in May registered a year-on-year increase of 3.5%, lower than the 5.6% growth recorded in April. Retail sales, considered a measure of consumption, also fell below the growth rate in April, with a 12.7% increase compared to the previous month's 18.4% growth.

Despite the low base caused by the closure and quarantine measures implemented during the COVID-19 pandemic last year, the momentum in production and consumption appears to be weak.

Furthermore, the preliminary economic activity data released by the National Bureau of Statistics indicated a decline in both the manufacturing sector and non-manufacturing sectors in May. The Manufacturing Purchasing Managers' Index (PMI) decreased by 0.4 points to 48.8, while the Non-Manufacturing PMI dropped by 1.9 points to 54.5.

Comments

No comment yet.