Early Signs of Recovery Observed

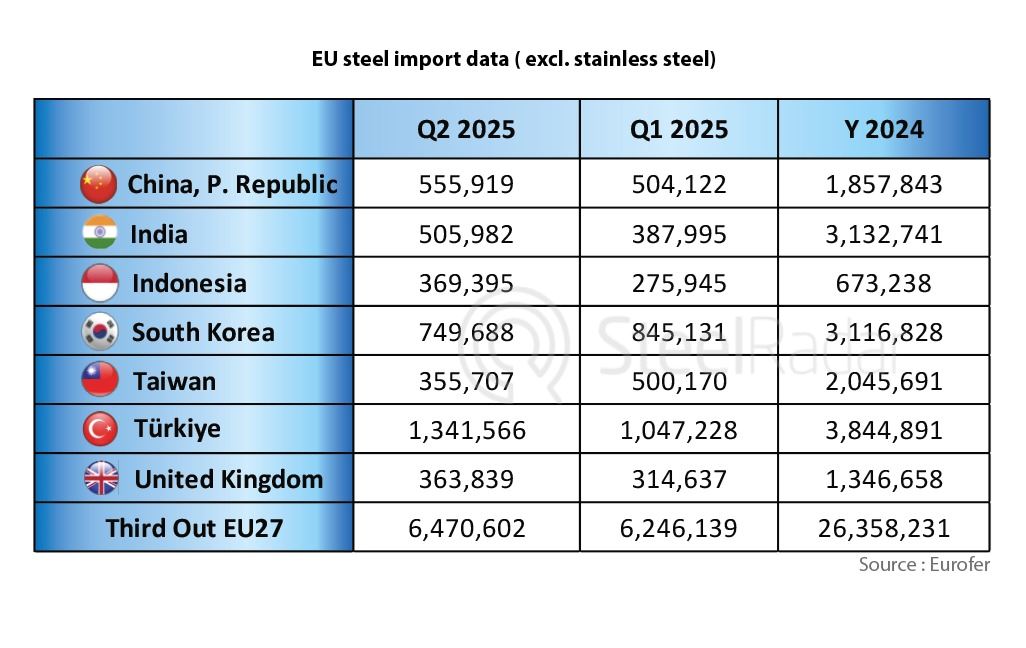

In the second quarter of 2025, the European Union’s steel imports from third countries rose by 3.6% compared with the first quarter, reaching 6.47 million tonnes. This moderate rebound, following two years of volatility, is seen as a sign that steel imports may be regaining momentum. Meanwhile, the European Commission has unveiled a new draft regulation designed to protect the EU steel industry from the negative trade impacts of global overcapacity. The proposal aims to create a permanent mechanism to replace the current safeguard measures, which will expire in 2026.

Türkiye Keeps Its Eyes on the EU Market

Türkiye continues to stand out as the EU’s strongest steel supplier, with total exports of 3.84 million tonnes in 2024. It not only recorded the highest quarterly increase but also maintained its position as the EU’s largest steel source on an annual basis, strengthening its strategic advantage. While this underlines Türkiye’s strong competitiveness in terms of price, quality, and logistics, the new draft regulation has raised questions about future prospects. Discussions have intensified over the potential advantages and disadvantages for Türkiye.

With the new EU steel import restrictions and the Carbon Border Adjustment Mechanism (CBAM) set to take effect in 2026, Türkiye’s leadership may face challenges. The proposed 50% tariff and additional costs linked to carbon emissions could weigh on competitiveness.

The other leading suppliers after Türkiye were listed as follows:

| Country | Imports (Q2 2025) thousand tonne | Change (Q1/Q2) |

|---|---|---|

| India | 505,982 | +30% |

| China | 555,919 | +10% |

| South Korea | 749,688 | −11% |

| Taiwan | 355,707 | −29% |

| Indonesia | 369,395 | +34% |

| United Kingdom | 363,839 | +15% |

India and China continue to strengthen their positions in the EU market, with India’s aggressive export growth particularly noteworthy. While some Asian suppliers such as South Korea and Taiwan have lost market share, new players like Indonesia are gaining ground. The United Kingdom has also become more visible in the EU market again after the post-Brexit decline.

Considering these trends alongside CBAM, the high carbon intensity of steel production in parts of Asia could weaken the competitiveness of these suppliers.

2026 Restrictions and the CBAM Effect

New Import Quotas: From 2026 onward, the EU plans to introduce an annual import quota of 18.3 million tonnes. Once this threshold is exceeded, additional tariffs of up to 50% will apply.

CBAM: The Carbon Border Adjustment Mechanism could significantly reduce the competitiveness of producers with carbon-intensive manufacturing. However, this may create an advantage for Türkiye, which benefits from growing green energy capacity.

Together, these two factors could challenge the market positions of high-volume exporters such as Türkiye, India, and China. Yet Türkiye’s ongoing investments in green energy and low-carbon steel production could give it an edge in retaining market share. For EU-based producers, these protectionist policies may offer new opportunities, while exporters face rising compliance and cost pressures.

Outlook: Short- and Long-Term Shifts Ahead

Short Term (through end-2025): Imports may continue to rise gradually, with Türkiye and India maintaining a strong presence in the EU market.

Medium Term (post-2026): CBAM and import quotas are likely to reshape supply chains. Green transformation investments by Turkish and Asian producers will be key to sustaining their foothold in Europe.

For both exporters and EU buyers, factors such as supply chain diversification, sustainability compliance, and strategic stock management are expected to become increasingly critical.

Comments

No comment yet.