As a result of the anti-dumping investigation conducted by the Ministry of Trade’s Directorate General of Imports, a fixed anti-dumping duty has been imposed on imports from China. The decision was published in the Official newspaper today (27 December 2025) and has entered into force.

Fixed Anti-Dumping Duty Set at 3.95%

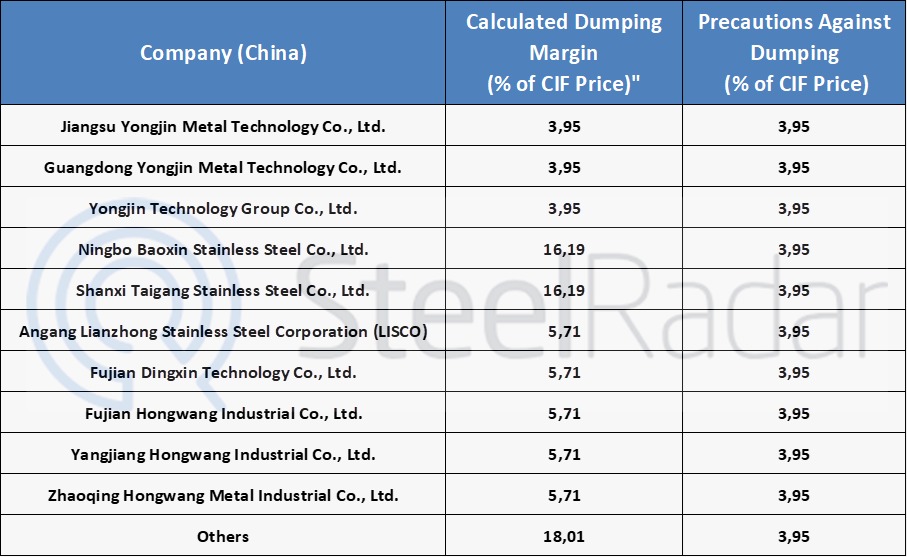

In the final notice published on 13 December 2025, anti-dumping margins for cold-rolled stainless flat steel imports from China were determined to range between 3.95% and 18%. However, with the new decision published on 27 December 2025, a fixed anti-dumping duty of 3.95% will be applied to all imports from China.

No Anti-Dumping Duty on Imports from Indonesia

Meanwhile, the investigation regarding imports originating from Indonesia found no anti-dumping margin. Following the Ministry of Trade’s evaluation, it was decided that imports from Indonesia would not be subject to any anti-dumping duty. This allows such imports, which were determined not to cause any material harm to Turkish domestic producers, to continue freely.

Implementation and Validity

The new measure will take effect as of 27 December 2025. Cold-rolled stainless flat steel products imported into Turkey will be processed by customs authorities under this new duty rate. The anti-dumping duties will remain in effect for five years after implementation. However, if a review investigation is initiated during this period, the application will continue accordingly.

Relevant HS Codes

The products covered by this measure fall under the following HS codes:

7219.31.00.00.00, 7219.32.10.00.00, 7219.32.90.00.00, 7219.33.10.00.00, 7219.33.90.00.00, 7219.34.10.00.00, 7219.34.90.00.00, 7219.35.10.00.00, 7219.35.90.00.00, 7220.20.21.00.11, 7220.20.21.00.12, 7220.20.29.00.11, 7220.20.29.00.12, 7220.20.41.00.11, 7220.20.41.00.12, 7220.20.49.00.11, 7220.20.49.00.12, 7220.20.81.00.11, 7220.20.81.00.12, 7220.20.89.00.11, and 7220.20.89.00.12.

Comments

No comment yet.