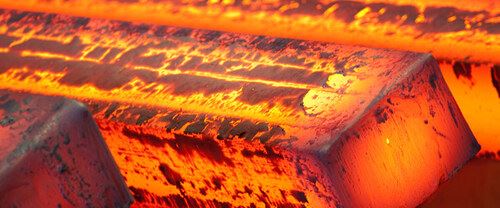

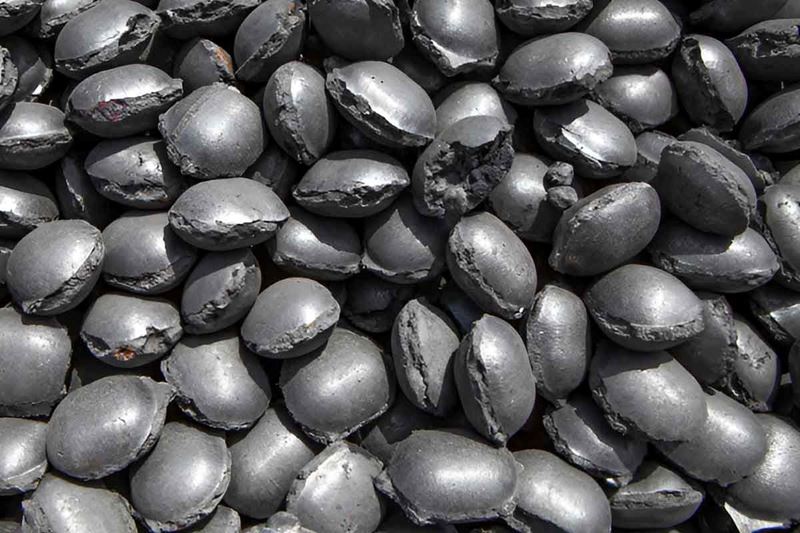

The domestic market in Iran is grappling with two key issues: a demand problem and a liquidity challenge, both of which are causing concern within the market. Over the past week, billet producers have ramped up their production capacities, leading to a noticeable anticipation of price reduction. The recent directive concerning billet and pellets has had an impact on stock market revenues, curtailing competition among traders in the billet and pellets buying sector. Consequently, it is expected that prices, during certain periods, will decrease.

The primary consequence of this trend will be a decrease in demand, as buyers await market stabilization, which in turn will drive prices down. In a market currently showing significant weakness, the decline in rebar sales, observed over the past three weeks in the stock market, is likely to intensify. While private factories can divert their billet and rebars to the broader market, state-owned factories are unable to do so outside of the stock market, resulting in liquidity issues – a predicament they currently face. It is worth noting that the reduction in domestic market prices is advantageous for these factories as it enhances their export capacity.

Comments

No comment yet.