The agreement, which has raised competitiveness concerns for many countries and sectors, is being closely monitored by the markets, particularly regarding its potential impact on the iron and steel industry.

This new trade framework between the European Union, one of the world’s largest markets, and India continues to spark debate over whether it will create risks or opportunities for countries that maintain strong trade relations with the EU.

At a time when global geopolitical tensions are intensifying and economic uncertainties are deepening, the agreement aims not only to strengthen economic ties but also to reinforce political relations between the parties. Representing a market of nearly 2 billion people and close to one quarter of global gross domestic product, this structure holds strategic importance for both Europe and India.

As the largest trade agreement ever signed between the EU and India, the deal envisages the removal of more than 90 percent of tariffs, while EU exports to India are expected to increase twofold on an annual basis. The agreement also seeks to preserve European standards, promote sustainable trade, and strengthen intellectual property rights.

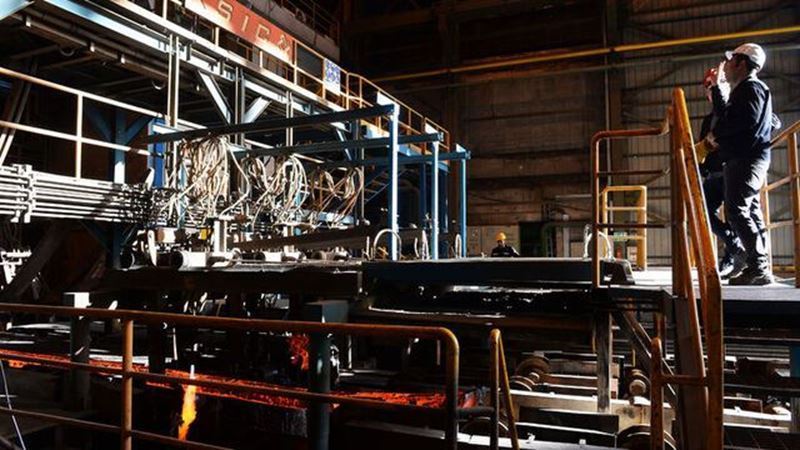

Although India’s steel production capacity is substantial on a global scale, current capacity is largely oriented toward meeting domestic demand, which limits the country’s export flexibility. While the agreement provides India with advantages on the customs side, CBAM related costs are expected to significantly constrain these benefits due to the low share of electric arc furnace production and high carbon intensity.

The EU’s primary objective is to reduce its dependence on China without deviating from its green regulatory framework; however, India is not yet fully aligned with this strategy in terms of green steel transformation. The agreement covers not only industrial goods but also agriculture, food, and various consumer products, thereby encompassing a much broader scope of trade.

India partially filling the gap left by China may create a risk of market share loss for Türkiye in certain product groups. However, when India, Vietnam, Indonesia, and MENA countries are evaluated collectively, it can be anticipated that Türkiye will continue to maintain a relatively stronger position in terms of production structure, logistical advantages, and regulatory alignment.

Comments

No comment yet.