The European Commission’s new steel import quota proposal, announced on 7 October 2025, includes changes that will directly affect Türkiye.

Under the regulation, which is expected to enter into force on 30 June 2026, around 1.2 million tons of steel exports from Türkiye are projected to be constrained by quotas. With the EU revising its global quotas downward, the volumes allocated specifically to Türkiye will also face significant reductions.

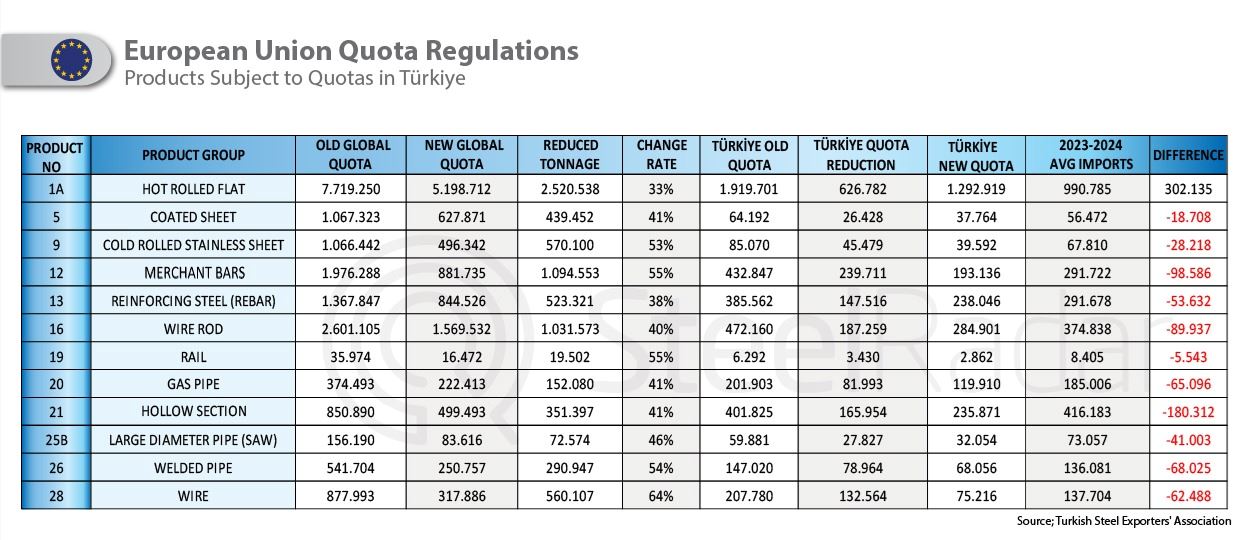

Among the 13 main product groups analyzed, hot-rolled coil (HRC) was the only category where the quota allocated to Türkiye exceeded the country’s average export volume. In all other categories, the quotas fell short of market needs.

According to data obtained by SteelRadar from the Turkish Steel Exporters’ Association, the steepest cut in the EU’s global quotas was in the wire rod category, with a 64% reduction, followed by merchant bars and rails, which declined by 55%. In country-specific quotas for Türkiye, wire rod again saw the sharpest decrease: the Türkiye quota will shrink from 207,780 tons to 75,216 tons, a 64% drop. Türkiye’s 2023–2024 average exports of wire rod to the EU stood at 137,704 tons, meaning the new quota falls nearly 62,000 tons short. In merchant bars, Türkiye’s quota will drop from 432,847 tons to 193,136 tons, a decrease of 239,000 tons — roughly 98,586 tons below its 2023–2024 average export level.

Similarly, in hollow sections, Türkiye’s quota will fall from 401,825 tons to 235,871 tons, placing the new ceiling about 180,000 tons below average shipments. In cold-rolled stainless sheet, the quota allocated to Türkiye will drop from 85,070 tons to 39,592 tons — creating a shortfall of 28,218 tons compared to average annual exports. Wire rod and welded pipes also remain well below Türkiye’s typical export volumes, with gaps calculated at 89,937 tons and 68,025 tons, respectively.

The only positive headline in the entire list is hot-rolled coil. Türkiye’s HRC quota will be set at 1,292,919 tons, which is roughly 302,000 tons above its average annual exports of about 990,000 tons. Overall, the EU’s revised quota framework significantly narrows Türkiye’s export space in profiles, wire rod, hollow sections, merchant bars and welded pipes. The new period indicates that access to the EU market — especially in the most heavily restricted categories — will become considerably more challenging for Turkish steel exporters.

Comments

No comment yet.