Under the acquisition, SIMS agreed to purchase all assets of Tri Coastal Trading for USD 66.5 million in order to consolidate its existing ferrous scrap operations in Houston.

Simultaneously, the company decided to sell the Mayo Shell property located in Houston. SIMS stated that proceeds from this sale will be used to finance a large portion of the Tri Coastal Trading acquisition. With the divestment of several assets in the Houston area, including Mayo Shell, total proceeds are expected to exceed USD 100 million.

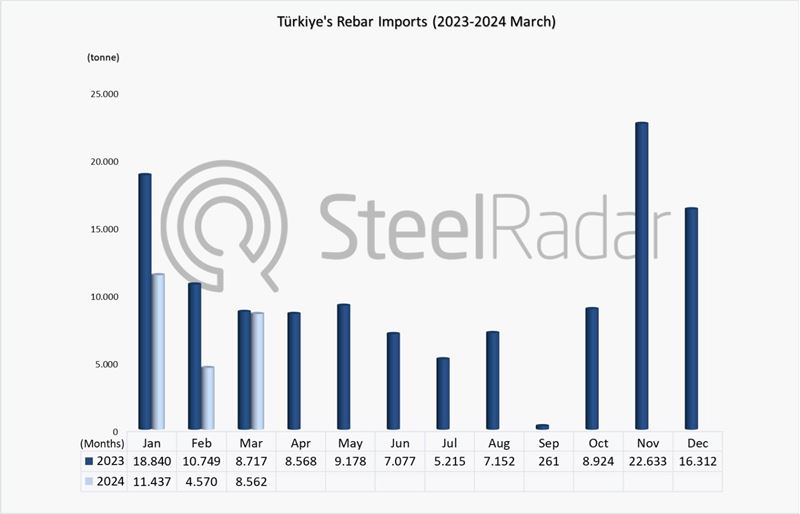

According to information published on Tri Coastal Trading’s website, the company generates annual revenue of more than USD 350 million. With an annual scrap processing capacity exceeding 800,000 tonnes, approximately 350,000 tonnes are exported. The majority of Tri Coastal’s exports are directed to the Mexico and Türkiye markets.

In its statement, SIMS emphasized that consolidating Houston operations under a single structure will deliver significant operating and administrative cost savings. The company added that this consolidation will also expand SIMS’ logistics capabilities, enabling domestic and international scrap metal supply and shipments via truck, rail, barge, and bulk shipping.

SIMS CEO and Managing Director Stephen Mikkelsen stated that while Houston operations have improved significantly over the past two years, the lack of direct access to a deep-sea port has limited the business’s potential. He noted that this issue couldnt be resolved at the Mayo Shell site without a substantial capital investment, and that the Tri Coastal acquisition provides a strategic solution.

Following the integration of the two businesses and the realization of expected synergies, the company forecasts that total EBITDA from Houston operations, including existing ferrous and non-ferrous activities, will exceed USD 25 million, based on current sales prices.

SIMS’ recent growth strategy has focused on assets with strong port access. The company acquired Northeast Metal Traders in 2023 and Pinkemba in 2021. Both assets are located in Brisbane, Australia, and have access to deep-water ports.

Founded in Australia in 1917, SIMS has a long-standing presence in the global scrap recycling market. Australia’s ferrous scrap exports recorded an 8.4% increase year on year, reaching 1.91 million tonnes. Supported by higher imports from Indonesia and Thailand, export volumes reached their highest level since 2014.

Comments

No comment yet.