In the first quarter of 2025, South Africa’s steel exports decreased by 19.4%, to ZAR 3.8 billion (USD 211 million). Although imports decreased by 4.3% during the same period, they still amounted to ZAR 5.9 billion (USD 328 million), resulting in a trade deficit of ZAR 2.1 billion (USD 117 million).

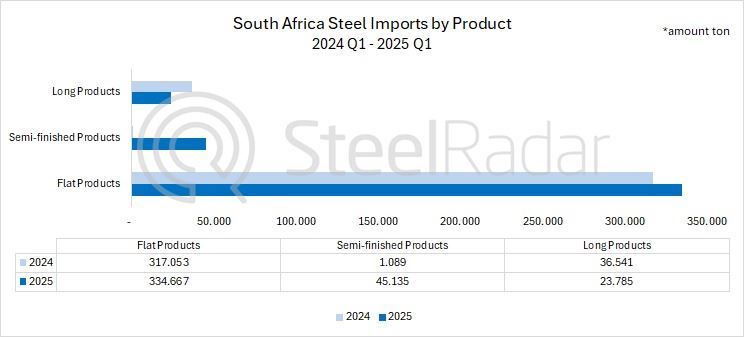

Flat steel imports increased by 5.6%, reaching 334,667 tons. While this increase reflects a lively market demand, it also intensifies the pressure on local producers. Galvanized sheets accounted for the highest share of imports at 28%, followed by hot-rolled coils at 24%, coated products at 15%, and cold-rolled products at 13%.

A particularly sharp rise was observed in semi-finished products. Imports increased from 1,089 tons in Q1 2024 to 45,135 tons in Q1 2025. This increase was largely driven by billet imports and has sparked concerns over dumping risks and pricing imbalances.

In contrast, long product imports decreased by 34.9%, from 36,541 tons to 23,785 tons. However, this decrease masks growth in certain critical product groups—such as cold-formed sections, bars, and rebar—indicating that domestic producers remain under pressure in key segments.

China’s growing investments are shifting the balance in Africa’s steel market

China’s investments in Africa bring both opportunities and risks as the continent continues its industrialization process. In October 2024, China’s steel exports to Africa increased by over 60%, reaching 18.1 million tons. While steel prices in Africa range between USD 850–1,200 per ton, the domestic price in China hovers around USD 552, allowing Chinese producers to generate substantial profits and intensify competition.

In response, some countries are partnering with Chinese firms to strengthen their local production infrastructure. Zimbabwe’s Dinson Iron and Steel Company, which began operations in 2024 with an annual capacity of 600,000 tons, has become one of the country’s largest industrial investments and is expected to contribute USD 5 billion annually to the economy. In South Africa, the state-backed Industrial Development Corporation is preparing to establish a major steel plant worth USD 4.5 billion in collaboration with China’s Hebei Iron & Steel Group.

Comments

No comment yet.