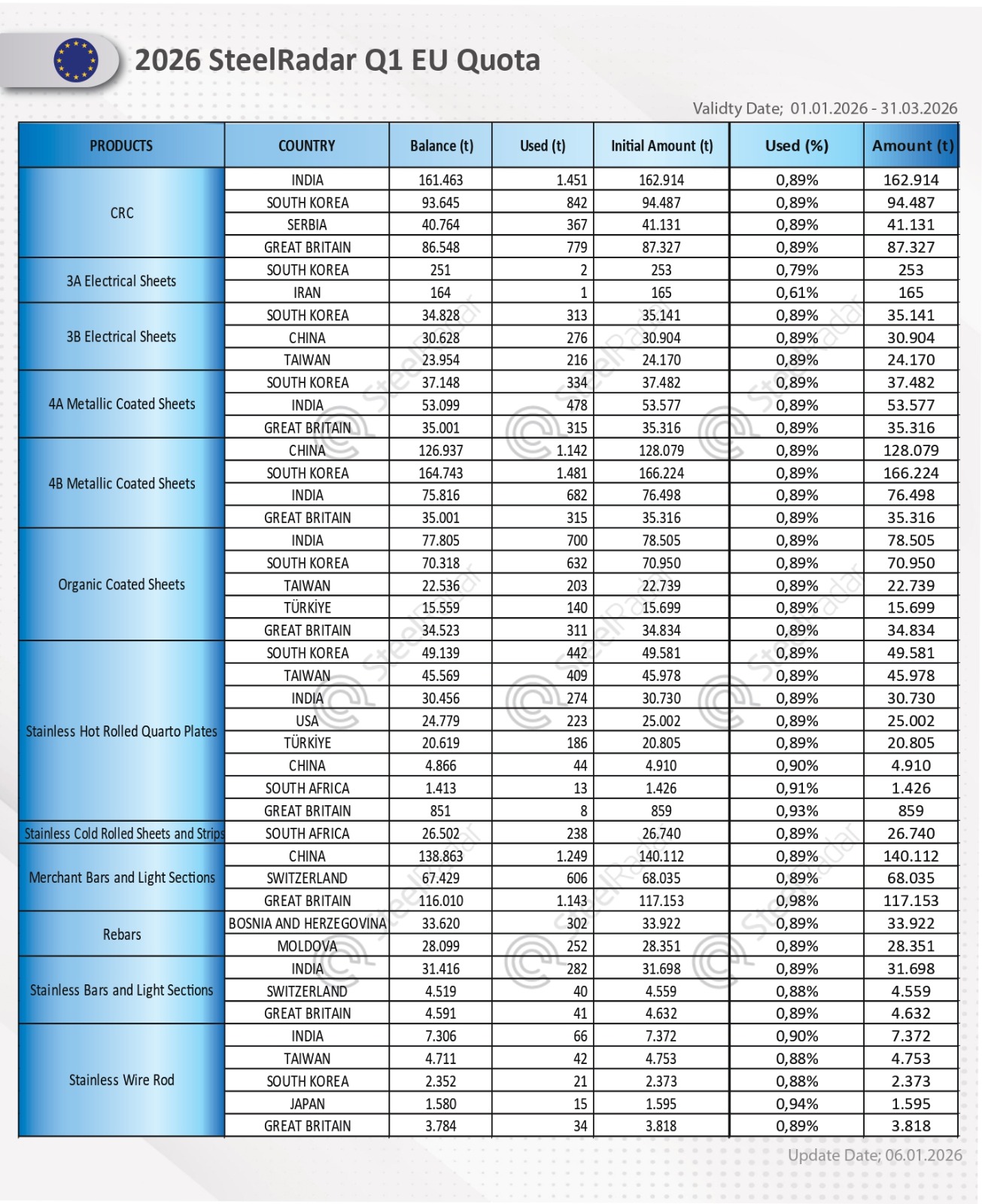

While quota volumes declined, it was striking that utilization rates remained below 1% across most product groups. According to sector sources, the main drivers behind this slowdown are the Carbon Border Adjustment Mechanism (CBAM), which entered into force as of 1 January, and rising import costs.

In the new period, the lowest quota utilization rates were recorded in the categories of 3A silicon electrical steel, stainless HR quarto plate, stainless wire rod, sheet piling, railway materials, and stainless seamless pipes. The limited progress in imports across most product groups indicates a cautious start to the market.

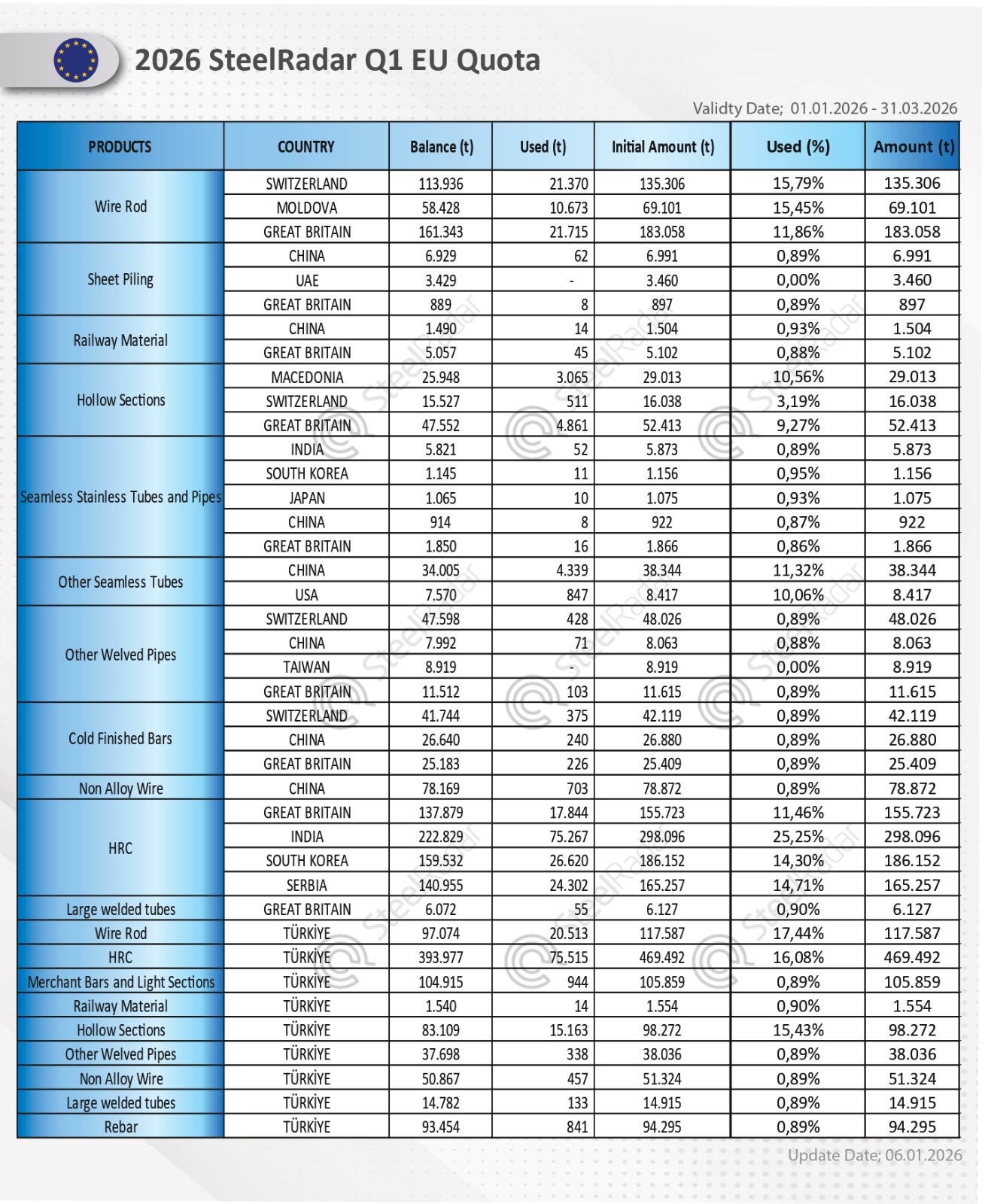

Relatively higher utilization rates were observed in HRC, wire rod, and hollow sections; however, even in these products, a noticeable slowdown was seen compared with previous periods. No product category approached a 50% utilization level.

In the HRC category, Türkiye reached a utilization rate of 16.08%, using 75,515 tons out of its initial quota of 469,492 tons. India recorded the highest utilization rate among countries at 25.25%, consuming 75,267 tons out of a quota of 298,096 tons. South Korea used 26,620 tons out of its 186,152-ton quota (14.30%), while Serbia consumed 24,302 tons out of 165,257 tons (14.71%).

In the wire rod category, the United Kingdom used 21,715 tons out of its 183,058-ton quota (11.86%), Switzerland consumed 21,370 tons out of 135,306 tons (15.79%), and Türkiye used 20,513 tons out of 117,587 tons (17.44%). Despite this, overall utilization levels remained lower than in previous periods.

On a country basis, Türkiye and India stood out in certain categories, while South Korea, the United Kingdom, Taiwan, and China recorded very low quota usage. China, in particular, showed very slow progress: it utilized only 11.32% of its 38,344-ton initial quota in the “Other seamless pipes” category, while utilization remained below 1% in all other product groups.

Overall, the data indicate that the implementation of CBAM has significantly impacted import behavior, with shipments to the EU proceeding cautiously in the first quota period of 2026.

Comments

No comment yet.