The European Commission (EC) presented a proposal on October 7 aimed at protecting the EU steel industry. While the proposal was welcomed by European steel producers, it raised concerns among the bloc’s trading partners.

The Commission’s proposal included the following measures:

-

Limiting duty-free import volumes to 18.3 million tons per year;

-

Raising the customs duty rate on products exceeding that quota to 50%;

-

Strengthening traceability in steel markets by introducing a rule that records steel volumes based on the country where they were melted.

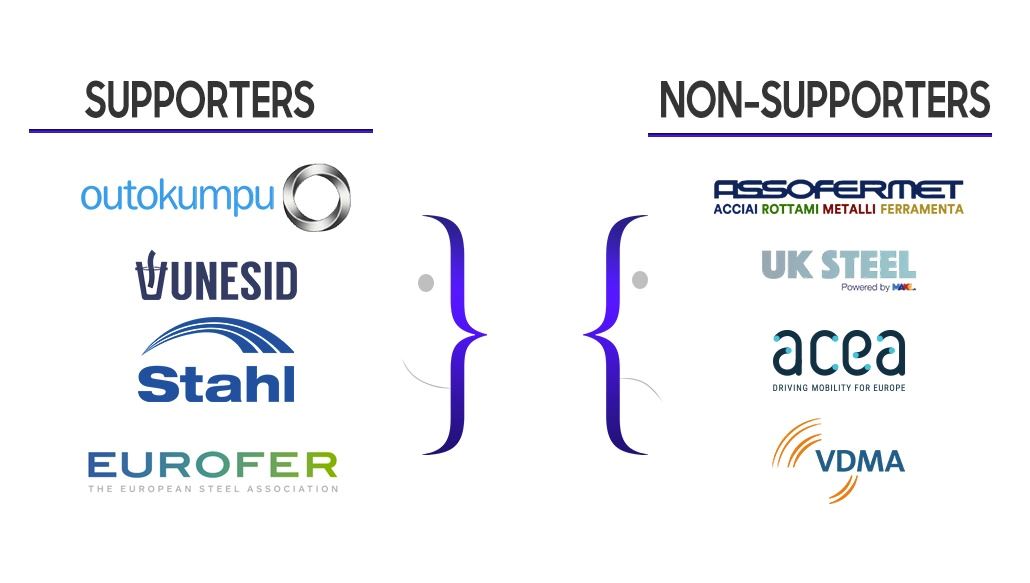

Voices of Support from the Industry

One of the supporters, Outokumpu, described the decision as a crucial step toward protecting Europe’s industrial base, ensuring economic stability, and advancing the green transition. The company stated that the TRQ mechanism is the most suitable and effective tool to shield the EU steel industry from the effects of global overcapacity.

It added that the proposed restrictions would prevent aggressive export surges, reduce circumvention risks, and ensure a fair balance for all operators in the European value chain. Furthermore, the non-transferability of unused quotas would help maintain market stability by preventing short-term import spikes.

The Spanish Steel Association (UNESID) also welcomed the proposal for similar reasons and called for its swift adoption so that the measures could enter into force at the beginning of 2026. UNESID representative Hermoso said that the measure offers an opportunity to restore the competitiveness of European steel and strengthen its role as a cornerstone of Europe’s economic, industrial, and environmental development.

Maria Rippel, Managing Director of the German Steel Federation (Wirtschaftsvereinigung Stahl), emphasized that the quick response from the strategic dialogue with Commission President Ursula von der Leyen 14 days earlier to the publication of the plan showed Brussels had grasped the seriousness of the situation. She also referred to necessary adjustments regarding the CBAM, noting that the mechanism aims to protect Europe’s energy-intensive steel sector from carbon leakage and should be extended to downstream products in the value chain.

EUROFER also expressed its support through its Director General, Axel Eggert, who stated: “This is an important step in defending the sector and clear evidence that the Steel Strategic Dialogue initiated by President von der Leyen is starting to bear fruit.”

Comments

No comment yet.