According to the document titled “Proposal for a Regulation to Address the Impact of Global Excess Capacity on the EU Steel Market,” the EU steel industry has long been facing severe competitive disadvantages due to sustained import pressure, high energy costs, and global overcapacity.

Although Europe remains the world’s third-largest steel producer, its production capacity has been declining, and several plants have been forced to close. According to Commission data, the sector has lost around 100,000 direct jobs since 2008, while production facilities in many member states have either downsized or shut down. This situation poses risks to the EU’s strategic autonomy, defense industrial capacity, and green transition goals.

In its statement, the Commission emphasized that “Steel is not only the backbone of industry but also the foundation of Europe’s green transition,” underlining the sector’s critical role in strategic fields such as construction, infrastructure, automotive, shipbuilding, wind turbines, railways, and defense.

New regulation: A permanent measure against global overcapacity

The new regulation will replace the current steel safeguard measures, which came into force in 2019 and are set to expire on 30 June 2026. The Commission notes that the risks of global overcapacity and trade diversion will persist beyond that date, highlighting the need for a new legal protection framework.

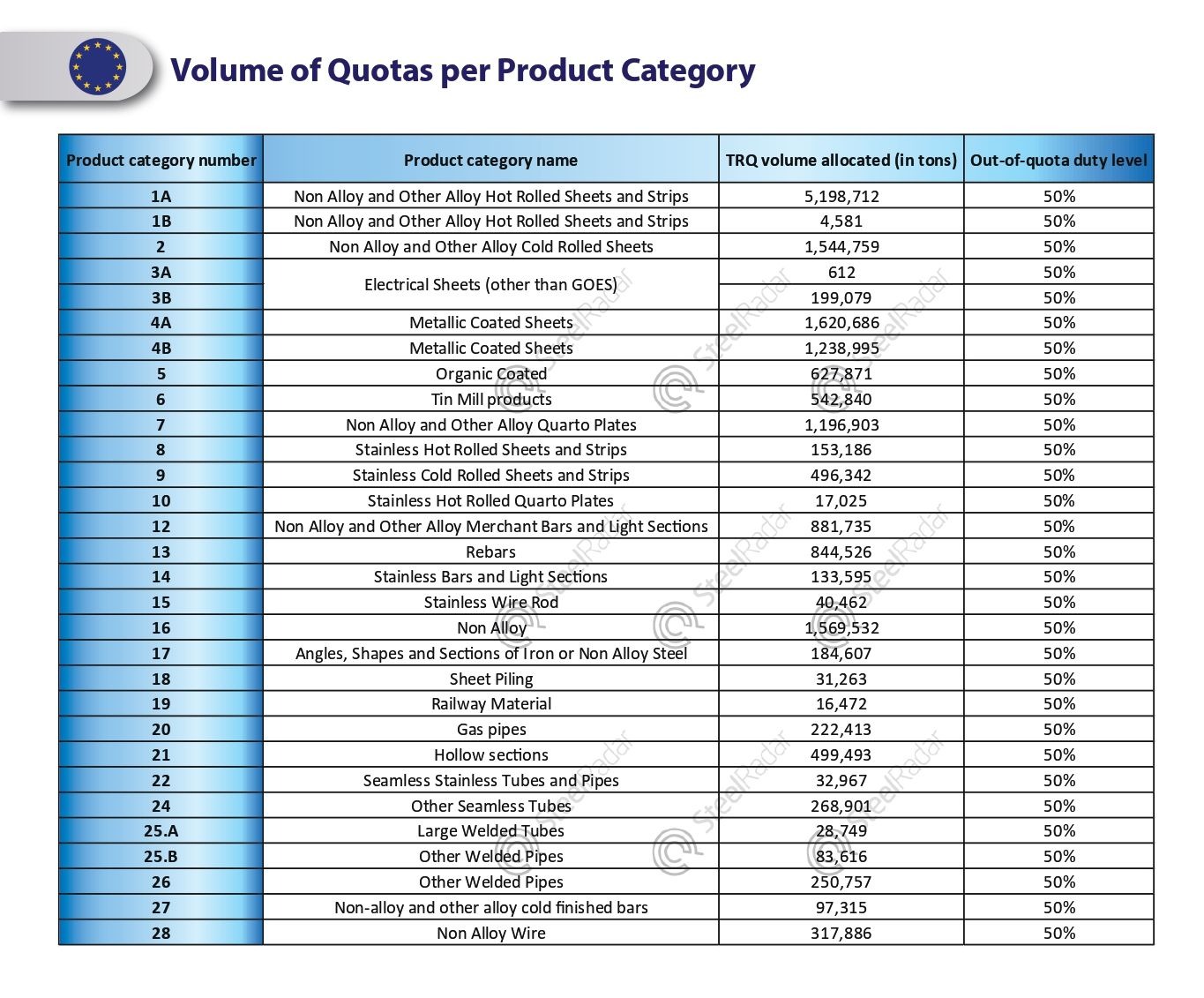

Under the proposal, imports will be allowed duty-free within specific quota limits. However, once these quotas are exceeded, a 50% tariff will apply (compared to the current 25%).

The quotas were calculated based on the EU’s 2013 steel consumption and import share, defining a total annual quota of 18.3 million tonnes. Any imports beyond this threshold will be subject to the new tariff.

The regulation also requires imported steel to be traceable by its “melt and pour” origin meaning the country where the steel was originally smelted and cast. This aims to ensure transparency over the true origin of steel that may be reprocessed in third countries before entering the EU market.

Products covered

The proposal covers 28 different categories of steel products, including hot-rolled flat steel, cold-rolled sheets, galvanized and coated plates, stainless steels, rebar, wire rod, pipes, rails, and heavy plates.

Some of the product categories with the highest quota volumes include:

-

Hot-rolled flat steel (Category 1A): 5.2 million tonnes

-

Cold-rolled steel (Category 2): 1.5 million tonnes

-

Metal-coated sheets (Category 4A): 1.6 million tonnes

-

Wire rod (Category 16): 1.56 million tonnes

-

Rebar (Category 13): 844,000 tonnes

All these products are defined under HS codes such as 7208, 7210, 7212, and 7306.

Linked to economic security and green industry goals

The Commission states that the regulation is connected not only to trade policy but also to economic security and defense strategies. Steel and metals are described as having strategic importance for Europe’s defense infrastructure, being essential materials in tanks, ships, and aircraft.

The new regulation provides the legal foundation for the priorities set out in the Steel and Metals Action Plan (SMAP), which aims to strengthen domestic production capacity in support of both green transition and defense industry goals, while maintaining the competitiveness of European industry.

The Commission announced that the regulation’s impact will be assessed through 2031, with scope reviews to be conducted every two years.

Comments

No comment yet.