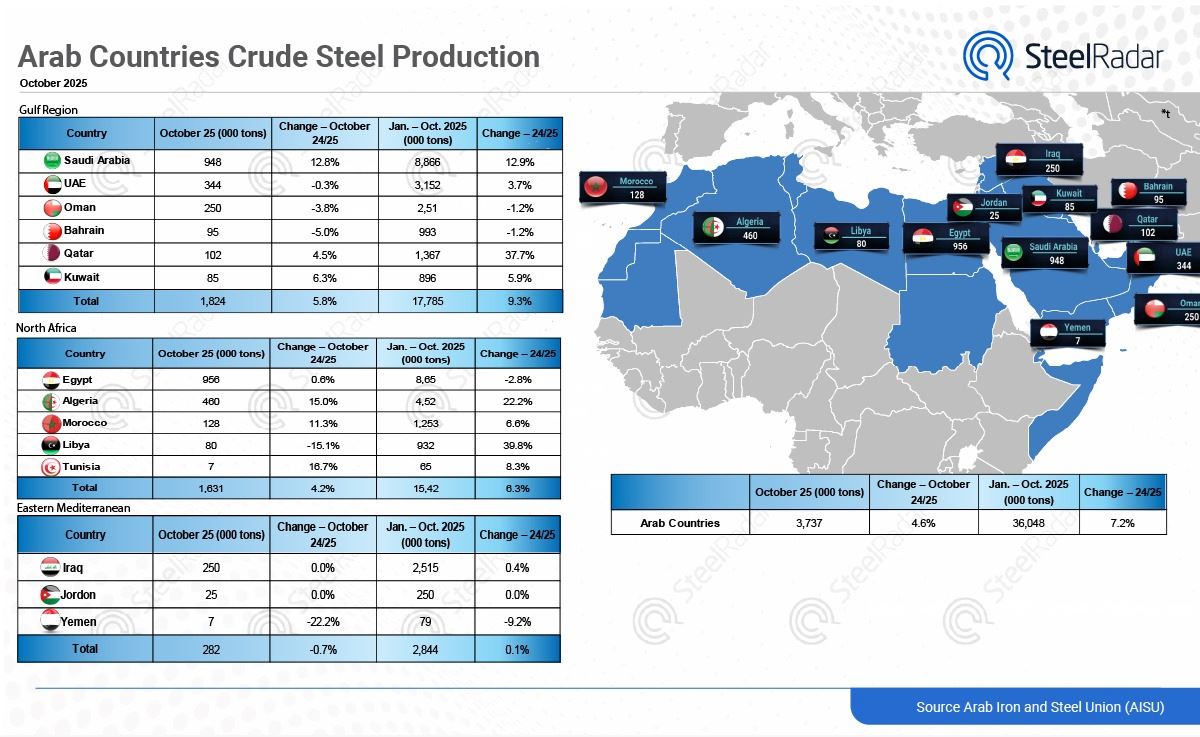

According to data obtained by SteelRadar from the Arab Iron and Steel Union (AISU), crude steel production in Arab countries reached 3.737 million tons in October, marking a 4.6% year-on-year increase. However, this figure was slightly below the 3.9 million tons recorded in September. Total output for the January–October period reached 36.048 million tons, indicating that the region continues the year with a notable 7.2% growth.

Despite a slight monthly decline, the Gulf countries maintain strong annual growth

The Gulf region maintained its central position in Arab steel production during October. While production decreased from 1.92 million tons in September to 1.824 million tons in October, the annual performance remained strong.

Saudi Arabia achieved an output of 948,000 tons in October, reflecting a 12.8% annual increase. The UAE recorded 344,000 tons, with a modest monthly decline of 0.3%. Qatar continued its growth driven by newly commissioned lines, producing 102,000 tons and achieving a 4.5% increase. Kuwait produced 85,000 tons, up 6.3% year-on-year, while Oman and Bahrain posted slight declines.

The Gulf’s total production for January–October rose to 17.785 million tons, registering one of the region’s strongest annual growth rates at 9.3%.

Significant annual recovery in North Africa

Steel production in North Africa reached 1.631 million tons in October. Although this figure was slightly below September’s 1.69 million tons, the region maintained its upward annual trend. Algeria continued to lead with 460,000 tons, posting 15% growth. Morocco’s output increased by 11.3% to 128,000 tons. Libya produced 80,000 tons, marking a strong 39.8% annual increase despite a monthly decline of 15.1%. Egypt’s production rose by 0.6% month-on-month to 956,000 tons but fell 2.8% on an annual basis. Tunisia recorded a 16.7% rise, reaching 7,000 tons.

North Africa’s total production for the January–October period reached 15.420 million tons, with annual growth standing at 6.3%.

Regional authorities evaluated the current outlook as follows:

“Unfortunately, the African steel market does not look good at the moment as we expected; only North Africa remains promising.”

This assessment indicates that North Africa maintains a relatively stronger position despite the broader weaknesses across the African steel market.

Production in the Eastern Mediterranean remained stable

In the Eastern Mediterranean, output remained unchanged at 282,000 tons in both September and October, indicating a stable but slow production trend. Total output for January–October reached 2.844 million tons, with annual growth limited to just 0.1%.

Iraq’s production remained flat at 250,000 tons, while Jordan also saw no change with 25,000 tons. Yemen’s production, however, dropped by 22.2% to 7,000 tons.

Strong year-end expectations

Overall, although crude steel production in Arab countries declined from 3.9 million tons in September to 3.737 million tons in October, the annual growth momentum remains intact. Production reached 1.824 million tons in the Gulf, 1.631 million tons in North Africa, and 282,000 tons in the Eastern Mediterranean.

The growth driven by the Gulf and North Africa continues to be supported by rising regional demand, higher capacity utilization, and new production lines coming online. With total output exceeding 36 million tons as of October, the Arab steel industry has further strengthened its position in the global market.

Comments

No comment yet.