THERE IS EXCESS OF CAPACITY IN LONG PRODUCTS IN TURKEY

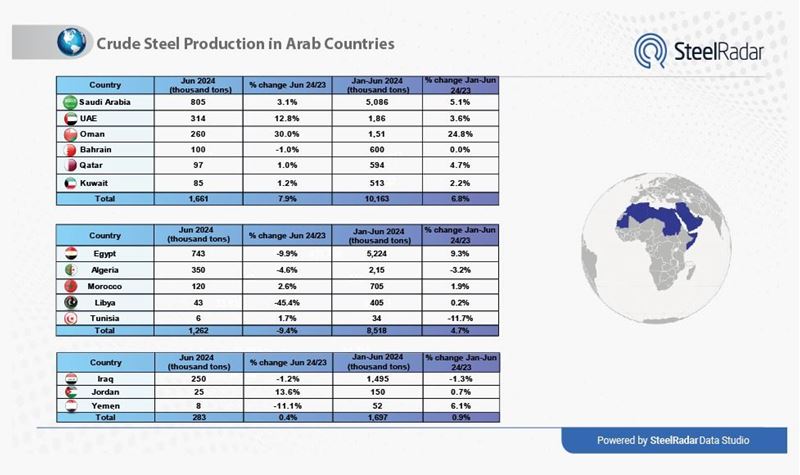

BSC, IE, MBA Operations Director Ali Der said, “There is a serious excess capacity in long products in Turkey. Algeria has serious exports from its Turkish competitors. Oman started to sell billet to Turkey. Bahrain rebar will go towards $620-$650. We are trying to solve the technical problems for entering and exporting to Israel, Yemen, Canada, America. Emirates Steel says that as soon as you say to make a hairpin, we do not go out of the things we know. There will be an investment of close to 6 million tons.' ‘Baosteel has signed a joint facility with Aramko. More investments are coming in flats, and they do not look at long products warmly.' he added.

Der ‘Saudi Arabia, on the other hand, is trying to make Turkey’s expansion 20 years ago. The oil for the next year was calculated as $76. The expectation of 2023, the pandemic process related to China affects us as well. There will be problems in the supply of scrap. Turkey's scrap purchases have decreased due to capacity reductions. Scrap dealers will tend to countries such as India and Pakistan. Turkey will not be able to have a say in the scrap as before. The European Union follows the rules and will remove quotas. We should not rush the transition to hydrogen, we need to wait and see new technologies,” he added.

25% TAX NEEDS TO BE AVOIDED

SEBA Foreign Trade Inc. General Manager Mert Odyakmaz; "The USA's 25% tax on Turkey continues. While the taxes of Mexico, Canada, Korea, Brazil and many other countries were abolished, ours continued. The sheet index was $1935 in August last year, now it has reached $660. Mexico has more say here, 25% starts in front of us. They are also more advantageous in freight, with an average freight price of $40-50… It seems very difficult to sell Turkey to the United States before the 25% tax rate is lifted.'

Kaptan Demir Çelik Foreign Trade Officer Oytun Özdoğan evaluated the Turkish markets with the following words;

Turkey 2022 first 6 months were not bad, but after the 6th month we did not spend well, the supply is high, there is no demand.

When it is a flat and wire rod industrial product, it increases a lot when it increases, but decreases a lot. Our exports decreased from 6.750 million to 5.2 million tons. Israel, Yemen, America, Canada are the countries we export to. The exports to Canada increased slightly, at the same level as the United States last year. 1.2 million tons of wire rod production was realized in 11 months compared to 1,352 million tons last year. Part of Turkey's production has turned to the domestic market. The energy crisis, the supply-demand balance puts Turkish exporters in trouble. The ever-increasing prices made our costs for the next month unpredictable. The scrap dealer collects less, Turkey uses less. Scrap prices are also solid, our cost is high. In the first 6 months of 2023, a challenging process awaits us again. We are hopeful for the second half.

Exports to Israel, Yemen and Central America continue. Turkey's full capacity operation is very difficult, and the rebar remained the weak link. There will be a serious capacity in Flats in the world. The government has to support us in energy prices, otherwise our job is very difficult. When we look at the scrap costs, the product prices are sold at a loss. The first 6 months of 2022 were good, but the last 6 months were a bit tough. China's steps in the Far East are very important. In the Middle East, the capacities are increasing, the costs will be more suitable, the competition will increase. Energy costs prevent us from being on equal terms.

ÇOLAKOĞLU Sales Manager Kürşad Aynas, regarding Turkey's 2023 flat sheet expectations, said, "Scrap will be more valuable due to green energy. Expectations are to go from $385 to 400 and above.'

Aynas said, “We pay the highest electricity price. It is very difficult for us to compete with the Far and Middle East. The energy costs between us vary between $60-80 per ton. We work during hours when energy costs are low and stop at other hours. In the same way, many factories in America stopped their production. Export markets will be very difficult in 2023, Europe is struggling with antidumping rates and quotas, we have little hope for exports, so we aim to work mainly in the domestic market.' He added.

“We hope that it will gain some movement after the second quarter of 2023,” he said. We aim to increase our flat production capacity from 3 million to 4.5 million. Tosyalı also has investments with an additional 4 million tons capacity. These capacities will reduce import rates, I don't think they will affect the domestic market much, but competition is good.' he concluded by saying.

Comments

No comment yet.