The consortium consists of Australia's BlueScope, as well as Japan's Nippon Steel, India's JSW Steel and South Korea's POSCO, it said in a statement to shareholders on Monday. The consortium said it had made a non-binding expression of interest to acquire and develop expanded operations at Whyalla.

BlueScope emphasized that the offer is subject to due diligence and return on investment conditions. The consortium sees Whyalla as a future low-carbon iron production hub in Australia for both domestic and export markets and could play an important role in the decarbonization of the global steel sector.

In 2017, POSCO also made an offer to buy Whyalla, but this offer was withdrawn following an offer from Sanjeev Gupta's GFG Alliance.

BlueScope, which operates the Port Kembla steel plant near Sydney, stated there was no obligation at this stage to convert the expression of interest into a formal offer.

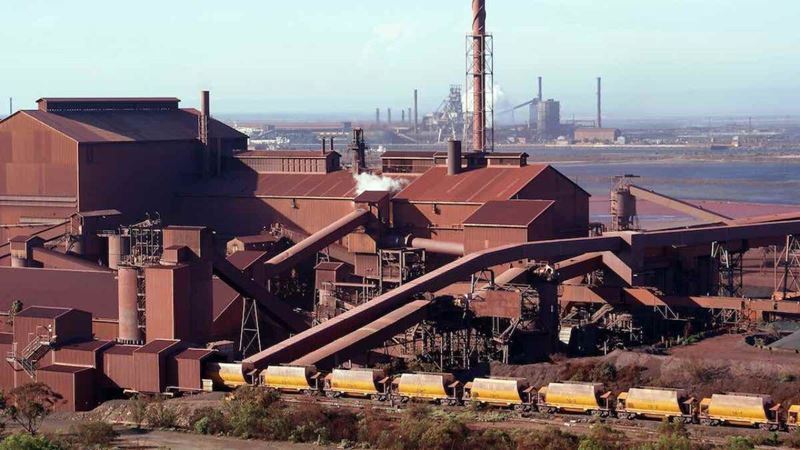

Whyalla is one of the two largest integrated steel plants in Australia and, as the country's only local rail producer, a major source of employment in the regional economy. The future of the plant is therefore politically sensitive.

The South Australian government provided a joint state and federal government bailout package of AUD 2.4 billion in early 2025 to keep Whyalla afloat and protect workers' jobs after Gupta pulled control from the GFG Alliance.

To decarbonize the plant, GFG committed to green steel production using hydrogen produced from renewable energy. However, this investment did not materialize. With the appointment of the plant's administrators in February, it was revealed that the plant had a debt burden of AUD 1.3 billion, including unpaid employee benefits.

A GFG spokesperson said the mill was experiencing “significant operational and financial challenges” due to external and internal factors.

Comments

No comment yet.