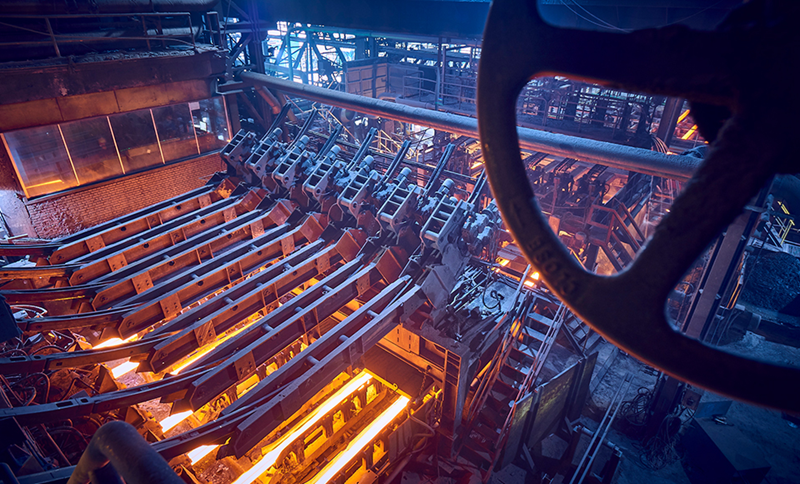

In a significant development impacting the construction industry, rebar prices in the Saudi Arabia have witnessed a remarkable surge in 2024, sending shockwaves through the market. This surge comes against the backdrop of a burgeoning construction boom fueled by ambitious infrastructure projects and urban development initiatives across the kingdom.

The price hike, which has caught the attention of investors, developers, and policymakers alike, is attributed to a combination of factors. Foremost among these is the demand for construction materials driven by mega-projects such as NEOM, the Red Sea Development, and the Riyadh Metro, among others. These initiatives, emblematic of Saudi Arabia's vision for economic diversification and modernization, have spurred a flurry of construction activity, creating an insatiable appetite for rebar.

Saudi Arabia plans to award construction projects worth $1.8 trillion in the next few years as part of its Vision 2030 economic diversification scheme, according to Investment Minister Khalid Al-Falih. These projects, aimed at building a sustainable economy, are expected to value nearly $3 trillion in the short term.

Additionally, global supply chain disruptions and logistical challenges have exacerbated the situation, leading to supply shortages and logistical bottlenecks. The ongoing geopolitical tensions in key metal-producing regions have further compounded these challenges, restricting the availability of raw materials and pushing up production costs.

Construction companies, already grappling with rising input costs, may face margin pressures, potentially impacting project timelines and delivery schedules. Moreover, the ripple effects of higher construction costs could translate into increased property prices and inflationary pressures, posing challenges for consumers and policymakers alike.

Comments

No comment yet.