The negative impact of the high inflation from the USA on the outlook of industrial metals caused aluminum, which has reached a record level, to breathe.

January inflation in the USA reached 7.5 percent, reaching the highest level in the last 40 years. This figure is St. Louis Fed President James Bullard has called for a 1 percent increase in interest rates for the next three months, but it is stated that there are also those who are not so hawkish among Fed officials.

The data of the London Metal Exchange showing an increase in aluminum stocks were also effective in the decline experienced on Friday.

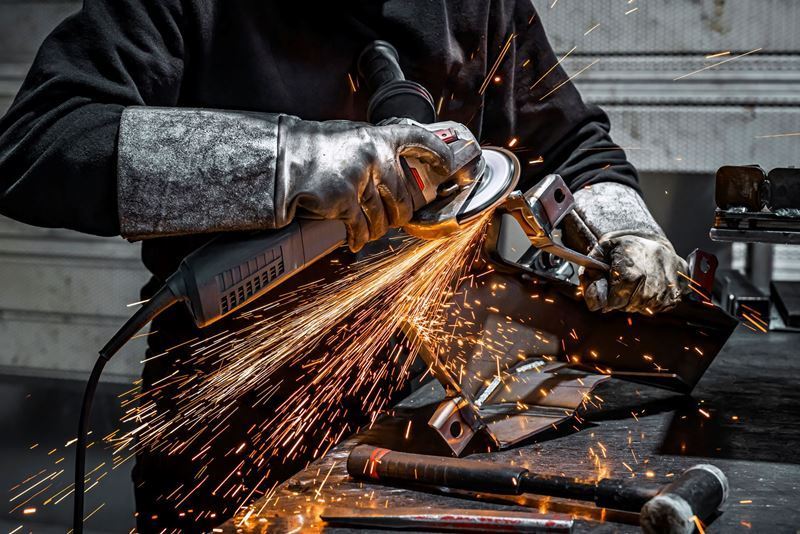

It is thought that the rising cost of aluminum, which is used in many areas from cans to frames and aircraft parts, can reduce the demand for the metal.

The metal, which saw its most valuable level in the last 13 years last week, was approaching record levels with the supply problems in Asia and Europe and the commitments made by China on monetary expansion and infrastructure expenditures.

China's economic agenda will be watched closely

Saying that the markets are pricing in rapid rate hikes by the Fed, Everbright Futures Co. His analyst, Zhan Dapeng, evaluated that investors will closely follow the path followed by Beijing, which seeks to stabilize economic growth.

While China is reducing the policy rate, it aims to support the economy, which has been injured due to the real estate sector, which has faltered, and the Kovid-19 cases that have started to increase again, with the infrastructure expenditures it has committed to make in the first period.

On the other hand, Citigorup Inc. In a note he passed, he stated that the metal that will be most positively affected by China's expansion policy may be copper and increased its quarterly price forecast to 11 thousand dollars per ton.

Aluminum prices hit $3,333 per ton on Thursday, the highest since 2008, close to the all-time record $3,380.

Aluminum fell 1.9 percent on the London Metal Exchange to $3,188 per ton.

Comments

No comment yet.