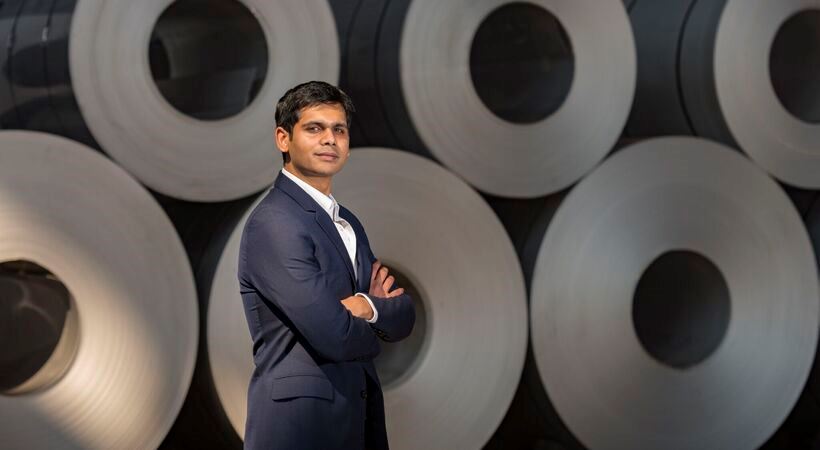

Abhyuday Jindal, Managing Director of Jindal Stainless, the largest stainless steel manufacturer in India, warns that despite robust domestic demand for stainless steel, margins in the fourth quarter of the current fiscal year may face strain primarily due to Chinese dumping. Moreover, European demand has yet to recover, and heightened freight rates resulting from the Red Sea geopolitical crisis have impacted US demand. In his last interview, Jindal addresses various topics including global economic conditions, margin pressures, the impact of the Carbon Border Adjustment Mechanism (CBAM), and the company’s investment in renewable energy.

Regarding the outlook for the fourth quarter, Jindal notes that domestic demand remains strong, but challenges persist due to Chinese import and dumping practices. Despite expectations, exports have not picked up as anticipated, with subdued demand in Europe and increased freight rates affecting margins and demand in the US. Jindal suggests that exports may require additional support, primarily at the government-to-government level, with a focus on addressing issues such as CBAM and awaiting improvements in the European economy and geopolitical stability.

Regarding the impact on margins, Jindal emphasizes that margins are under pressure primarily due to dumping in India. He also discusses the recent release of default values for embedded carbon emissions under CBAM, expressing that it is premature to analyze the full impact, given the evolving regulatory landscape and potential complexities in justifying conventional energy resource usage in Europe.

Jindal indicates that Jindal Stainless is proactively preparing to align with CBAM requirements, with processes and reporting mechanisms in place and engagement with relevant authorities for monitoring carbon emissions at their plants. In terms of investments, Jindal highlights a ₹700-crore (217 million USD) plan over three years for renewable energy projects, including initiatives such as round-the-clock availability of renewable power and investments in green hydrogen production. The company aims to reduce carbon emissions by 50% by 2035 through these efforts.

Comments

No comment yet.