The main drivers of this growth will be the expansion of EAF capacity, tightening scrap availability, and the new policy framework shaped particularly by the EU’s CBAM regulations.

Regional demand outlook

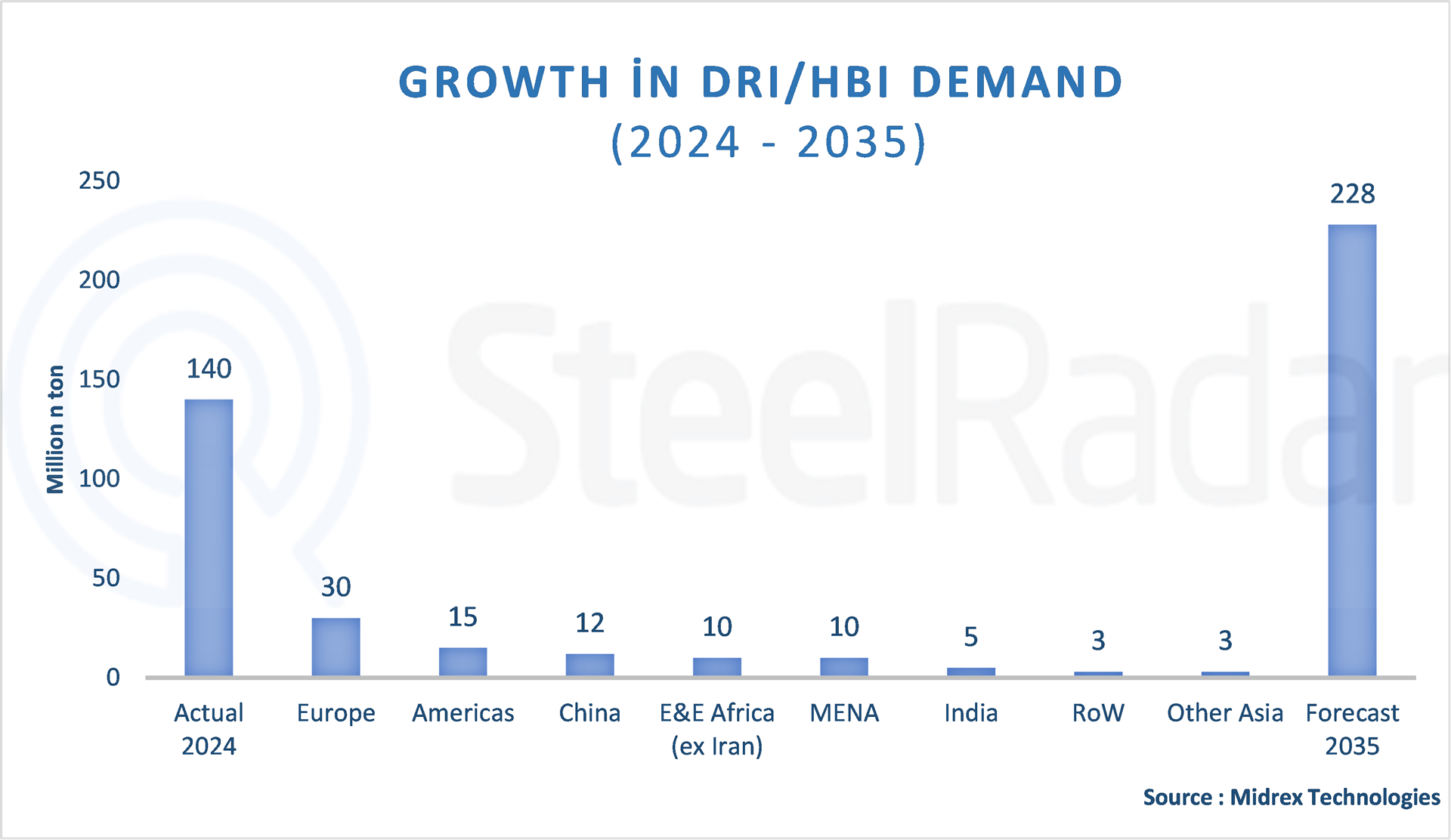

According to Midrex data:

• The MENA region will remain the global hub of DRI/HBI, both in terms of consumption and exports.

• India, although maintaining its coal-based steel production profile, will be the market with the highest net increase in demand by 2035.

• Europe will become the region with the sharpest growth as it moves away from the blast furnace basic oxygen furnace (BF–BOF) production route.

• North America will double its DRI/HBI demand, driven especially by EAF investments focused on flat steel production.

• The outlook for China remains uncertain: even an increase of only 10–15 Mt by 2035 could have significant impacts on the seaborne trade of HBI

It is emphasized that realistic expectations about the speed of decarbonization revolve around the question of “how fast” the steel industry will be decarbonized, rather than “whether” it will be decarbonized. Accordingly:

• Many global forecasts for hydrogen-based steel production unrealistically downplay both the investment requirements and the operational challenges

• Due to limitations in renewable energy infrastructure, policy uncertainties, high capital costs and constraints in the technology supply chain, many producers are postponing or scaling down H2 projects.

• Although the EU is struggling to accelerate “green steel” investments due to low profitability in the steel sector, it will maintain its leadership position through political guidance and incentives

Gradual transition: Natural gas → Hydrogen

In the short to medium term, the most feasible scenario will be a gradual shift from natural gas–based DRI production to hydrogen-based production. Since the widespread adoption of fully hydrogen-operated plants will take time, the industry is focusing on more cost-effective, incremental solutions. As a result, the production of “greener DRI” will continue to be a key determinant in the global supply–demand balance.

Comments

No comment yet.