According to data obtained by SteelRadar from the German Steel Federation (Wirtschaftsvereinigung Stahl), Germany’s crude steel production fell by 8.6% in 2025 compared to 2024. Total crude steel output amounted to 34.1 million tonnes, around 9% below the already very low level of the previous year. Since Germany’s reunification, a similarly low figure had only been recorded during the 2009 global financial crisis.

Capacity utilization fell below 70%, dropping under the critical threshold for the energy-intensive steel industry. As a result, production remained well below the 40 million-tonne level for the fourth consecutive year — a level generally considered the minimum for sustainable capacity utilization in the sector.

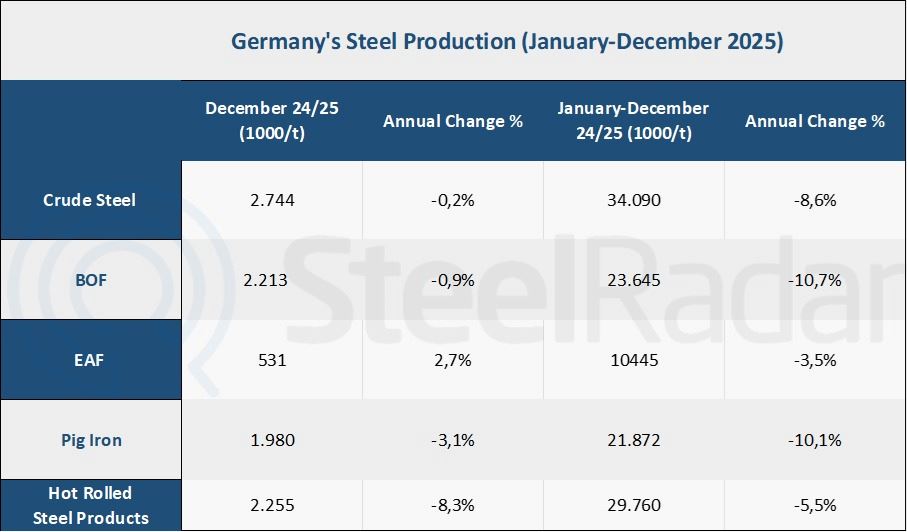

Data for the final month of the year showed no signs of recovery. In December 2025, total crude steel production amounted to 2.744 million tonnes, down 0.2% year-on-year. BOF steel production declined by 0.9% to 2.213 million tonnes, while EAF steel output rose by 2.7% to 531,000 tonnes. Pig iron production fell by 3.1% to 1.98 million tonnes, whereas hot-rolled steel output increased by 8.3% to 2.255 million tonnes.

Looking at full-year figures, declines were seen across all major product groups. BOF steel production fell by 10.7% to 23.645 million tonnes, while EAF production decreased by 3.5% to 10.445 million tonnes. Pig iron output declined by 10.1% to 21.872 million tonnes, and hot-rolled steel production dropped by 5.5% to 29.76 million tonnes.

Weak production trends were accompanied by weak domestic demand. Preliminary data indicate that steel demand in Germany remained exceptionally low through October 2025. Estimated market supply of around 30 million tonnes for the full year remained below the already weak average of the past four years.

“2026 must be the year the sector is secured”

Commenting on the data, Kerstin Maria Rippel, Managing Director of the German Steel Federation, stated that the declines in production and demand stem from structural problems, with the industry facing multiple pressures simultaneously. She cited historically weak demand, uncontrolled growth in imports, and internationally uncompetitive energy prices as key challenges. While the German government and the European Commission are working on countermeasures, Rippel stressed that concrete actions have yet to be implemented and that, given the deteriorating geopolitical environment, progress must be accelerated. According to her, 2026 must be the year in which the sector’s future is secured.

Developments on the import side are also a cause for concern. Around one-third of steel consumed in the EU now comes from non-EU countries. Global overcapacity — particularly from Asia — and increasingly aggressive and unpredictable U.S. trade policies are intensifying pressure on the European market. Under these conditions, Rippel said it would be difficult for the sector to recover on its own in 2026, emphasizing the need for the European Commission to swiftly and decisively implement effective trade protection measures.

Energy costs remain a central issue. Rippel noted that uncompetitive electricity prices are placing a heavy burden on current production and hindering the transition to climate neutrality. In the medium term, the goal should be an internationally competitive electricity price of 3–6 euro cents per kilowatt-hour, including grid fees, taxes, and levies. Key measures include permanently reducing grid charges, extending electricity price compensation schemes indefinitely, and allowing industrial electricity pricing and compensation mechanisms to operate in parallel.

The association also stressed the importance of developing low-emission steel markets for future growth. The creation of targeted “lead markets” for low-carbon steel produced within the EU could provide a new economic impetus. In this context, ongoing reforms to public procurement law are seen as crucial. Increasing the mandatory use of low-emission materials in public projects and introducing EU content requirements to stimulate demand for climate-friendly steel are highlighted as essential steps.

Finally, the association pointed out that the proposed EU Industrial Accelerator Act could help stimulate demand in steel-consuming sectors. Such measures could foster reliable lead markets for low-emission steel and serve as an effective economic incentive for the industry’s transformation.

Comments

No comment yet.