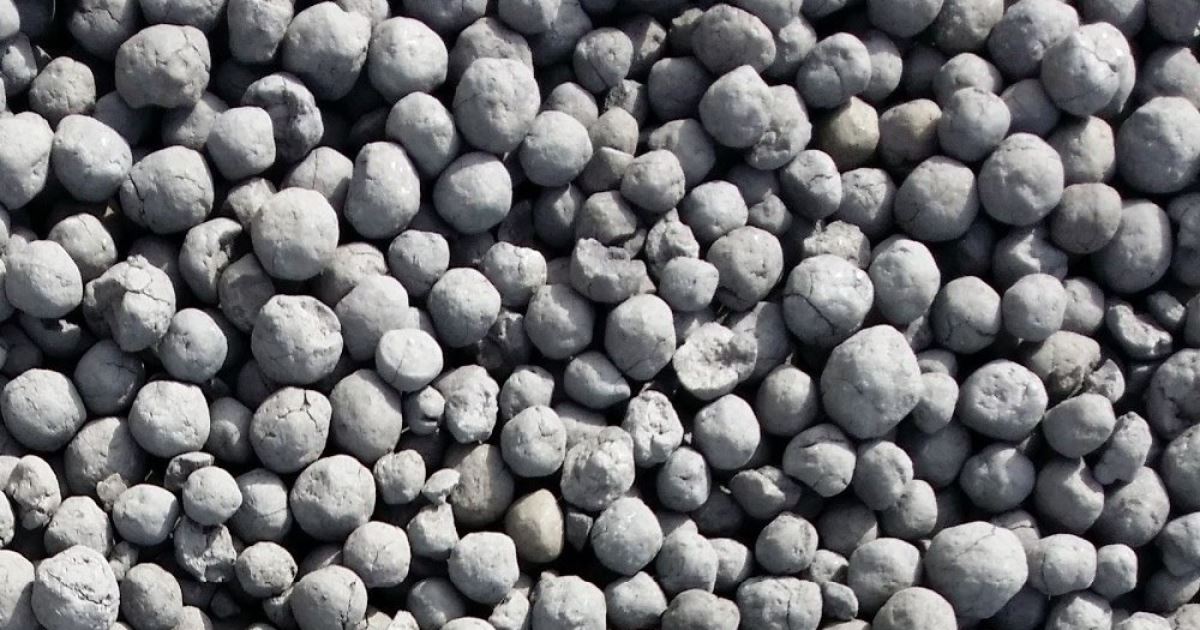

In Libya, the Libyan Iron and Steel Company was active in export negotiations and managed to close deals for around 72,000 tonnes of HBI. The company focused on its usual markets, including Europe and parts of MENA. However, no DRI sales have been made by the producer so far this year.

In Algeria, Algerian Qatari Steel was also out of the DRI export market in June. The company isn’t expected to offer any material until the end of July due to supply limitations.

Iran, another key supplier in the region, was quieter than usual. Political and military developments caused delays and made buyers more cautious. While some mills still tried to stay active, most deals were delayed. One Iranian producer, Sirjan Jahan Steel Company, opened a tender for 25,000 tonnes of DRI, with a deadline set for June 30.

With limited supply from the main MENA producers, some buyers turned to other regions. Offers from Venezuela were heard at $300–305 per tonne FOB, and some interest was reported, especially from buyers looking to avoid risks in the Middle East.

Comments

No comment yet.