Despite challenges like a sluggish domestic demand and a construction sector crisis, Chinese steelmakers experienced a notable 36.2% YoY increase in exports in 2023, reaching 90.3 million tonnes—the highest level since 2016.

Simultaneously, the China Association of Automobile Manufacturers reported a significant surge of 63.7% in vehicle exports, totaling 4.1 million units.

While China exceeded its 2023 GDP growth target, reaching 5.2%, there are predictions of a slight decline to 4.6% in 2024 and 4.3% in 2025, according to a broker consensus. The reliance on exports makes the ongoing Red Sea shipping crisis a potential risk to China's GDP growth, with the added concern of exposing overcapacity in the steel industry and impacting prices.

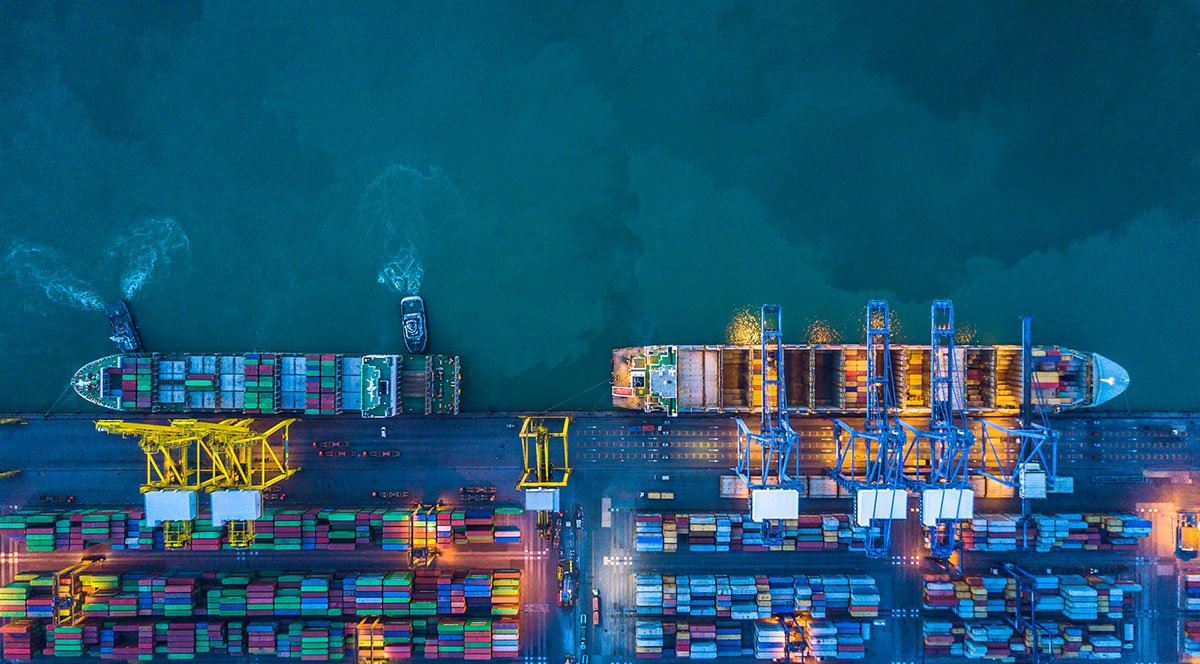

Despite outperforming 2022's crude steel production volumes by November, China's National Bureau of Statistics reported almost flat output in 2023, standing at 1.02 billion tonnes. The challenges faced by shipping companies due to the Red Sea crisis are affecting the appeal of imports to customers in Europe and the United States.

Shipping companies, including Denmark's Maersk, have diverted vessels away from the Suez Canal, and steel shipments have been affected, with a South Korean steelmaker's cargo seized in December. The alternative route around South Africa's Cape of Good Hope has significantly increased shipping distances and times. As of January 18, transport costs rose to USD3,777 per 40-foot container, marking an 82% increase from the same week in 2023 and a 166% surge from the average 2019 rate.

Facing these challenges, some Asian steelmakers have withdrawn from the European market, while others shifted to Free On Board (FOB) offers, requiring buyers to arrange their own transport. Despite these difficulties, China is unlikely to withdraw from the market as it pursues new GDP growth targets in 2024.

Comments

No comment yet.