The Chinese real estate company Evergrande, who was in the debt crisis, postponed its debt, could not pay it on time and China's unsupportive attitude fueled the belief that similar events could happen in the economic markets.

The grace period for the company to pay its $148.1 million interest debt on three October 12 foreign debt bonds expired on November 10. The US economic news agency Bloomberg, the Chinese media outlet Cailianshe and the New York Times reported that the company made payments to the debtors in their news on the subject.

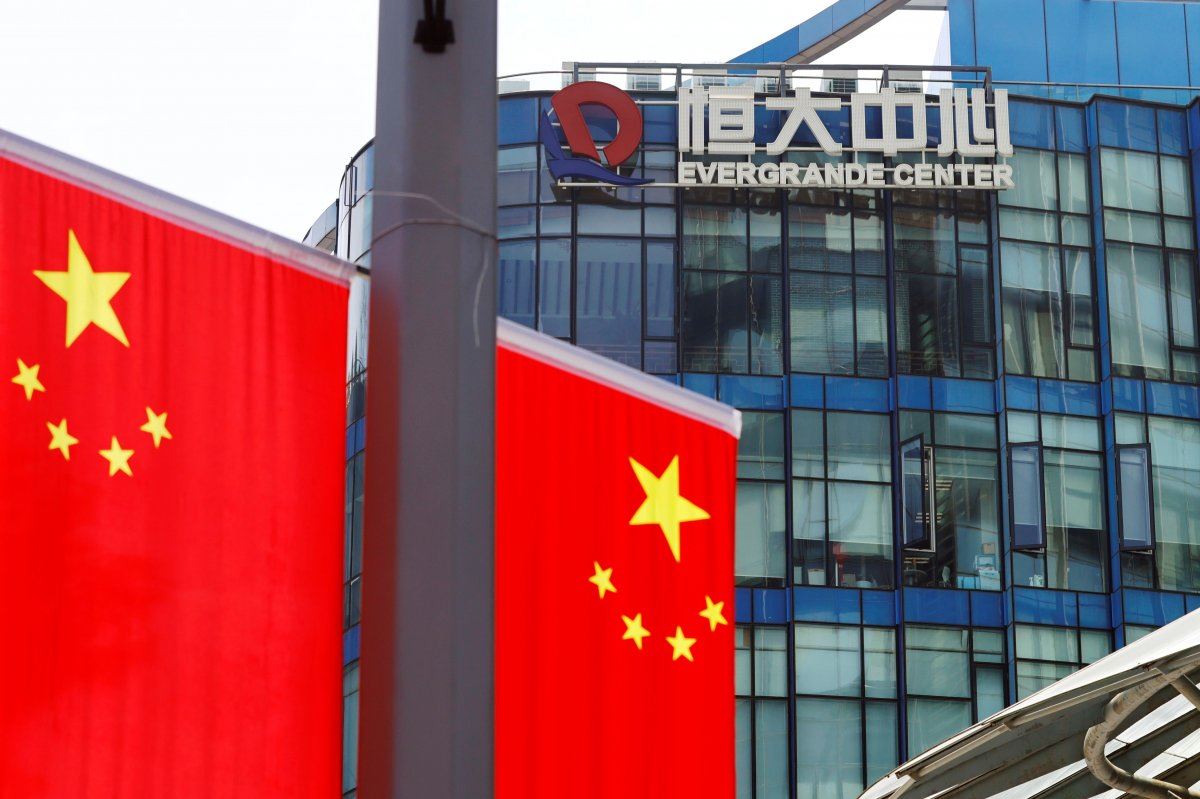

IN DEBT CRISIS, EVERGRANDE AVOID FROM Default Once Again

Evergrande, the Chinese real estate company in debt crisis, avoided default by paying the interest on foreign debt bonds that were due in October but could not repay before the 30-day tolerance period expires.

The news in question indicates that the company is avoiding default by paying its debt interests.

CHINA owes as much as 2% of GDP

With total assets of 2.38 trillion yuan (about $370 billion), the group has debt obligations of 1.97 trillion yuan (about $305 billion), which amounts to about 2 percent of China's Gross Domestic Product (GDP).

The fact that a company of this size has trouble even in small foreign interest payments is considered as a sign that a larger-scale debt crisis is at the door.

It is feared that the group, which has debts to 171 banks and 121 financial institutions in China, falls into payment difficulties, which may lead to a credit crunch across the country.

The company is expected to take acquisition and transfer steps regarding its other assets in the coming months.

Comments

No comment yet.