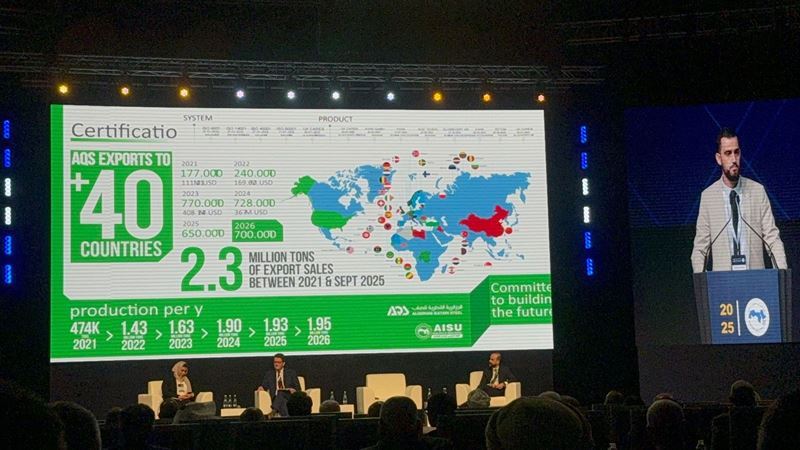

Speaking at the Arab Steel Summit 2025, AQS’s Abdelkadir Khellaf evaluated the success of the Algeria-Qatar joint venture and the challenges created by rising protectionist trends in global steel trade.

Emphasizing that AQS is a model for cooperation among Arab countries, Khellaf stated, “Our journey in the steel sector started in 2017 with partial production. By the end of 2021, all our production lines reached full capacity. Since then, we have exported a total of 2.3 billion tons of steel to more than 40 countries across four continents.”

“Access to the EU market is becoming increasingly difficult”

Khellaf stated that the EU steel protection measures implemented since 2018-2019 have gradually restricted Arab exporters’ access to the European market.

According to the data, the EU’s construction rebar quota for the “other countries” category decreased from 138,000 tons in 2024 to 27,000 tons, which sharply reduced export share. He also recalled that the 15% quota imposed on another country in 2023 caused exports to decrease by 86%.

Khellaf emphasized that “the EU steel industry is currently under economic, political and social pressure,” adding that new proposals would make the situation even more challenging:

“The European Commission plans to reduce existing quotas by 47% and increase out-of-quota tariffs from 25% to 50%. This is a step taken to protect European steel producers, but it seriously disrupts global trade.”

“Global surplus will reach 721 million tons by 2027”

Khellaf stated that global steel capacity is expected to reach a surplus of 721 million tons by 2027. This increases price pressure, while steel demand in Europe remains below pre-pandemic levels:

“As of 2024, steel demand in the EU is 16 million tons lower than in 2019. Demand is weak, prices are falling, yet trade restrictions are increasing.”

Khellaf also stated that similar protection measures are applied in the UK and US markets. Post-Brexit measures to protect domestic production led to significant declines in export quotas. Steel exports to the US account for 7% of total exports, while the EU’s 3.8 million tons of steel sent to the US represents 16% of its total exports. Khellaf emphasized that these imbalances also create cascading effects in markets such as Canada.

“CBAM is not an environmental policy, it is a new trade tax”

Khellaf criticized the EU’s Carbon Border Adjustment Mechanism (CBAM):

“The EU presents CBAM as an environmental regulation, but this application is increasingly becoming a trade tax. Climate change is real and we must protect the environment, but CBAM has turned into a new trade barrier restricting imports.”

He also emphasized the financial impact of CBAM:

“The cost for only 100,000 tons of steel reaches at least EUR 4.7 million. When default emission values are used, this exceeds EUR 8.4 million. Over the nine-year phased implementation, the total cost will increase by more than 60%.”

“Change must start from within”

Concluding his speech, Khellaf emphasized that Arab steel producers must act collectively against global protectionism:

“Change must start from within. Public and private sectors should work together to increase domestic demand and ensure sustainable growth. We should develop a joint market strategy through regional trade agreements.”

Comments

No comment yet.